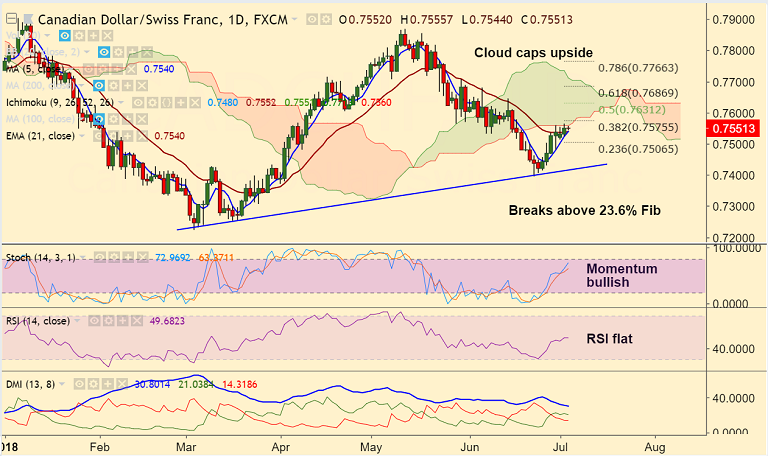

- CAD/CHF is extending range trade around major support at 0.7540 which is converged 5-DMA, 100-DMA and 21-EMA.

- Momentum studies are bullish, Stochs are sharply higher, but RSI has flattened out just shy of 50 level.

- We also see bullish divergence on Stochs and break into cloud could see further gains for the pair.

- Next strong resistance lies at 200-DMA at 0.7633. Breakout at 200-DMA will propel the pair higher.

- On the flipside, break below strong support at 0.7540 will see resumption of weakness. Drag till 0.7415 (trendline support) likely.

- Breach at 0.7415 could see major weakness for the pair.

Support levels - 0.7540 (converged 5-DMA, 100-DMA and 21-EMA), 0.7506 (23.6% Fib), 0.7415 (trendline)

Resistance levels - 0.7560 (cloud base), 0.7575 (38.2% Fib), 0.7633 (200-DMA)

Recommendation: Good to go long on break above daily cloud base, SL: 0.7530, TP: 0.7575/ 0.7630.

FxWirePro Currency Strength Index: FxWirePro's Hourly CAD Spot Index was at 89.6803 (Bullish), while Hourly CHF Spot Index was at -88.3486 (Bearish) at 0545 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.