We, at FxWirePro, have been sensing a change in the commodities market for quite some time now. After months and years of battering by traders and investors, this year, they are once again becoming the darlings. Many of the commodities have risen more than 20 percent this year and that figure in most cases will be much larger if we consider it from the bottoms, which were largely made earlier this year.

In this FxWirePro Commodities Watch, we are to present our readers the performance of the various commodities, categorically classified, which are key to understand the broader global economy. For example, copper is considered as a barometer of global economic activity or gold is considered as a safe haven.

We consider the commodities as must watch due to their impact on inflation.

Hence we present to our readers, the performance of commodities, which in turn decide the wellbeing of many commodity-producing nations. For example, Russia, Saudi Arabia, and Qatar benefit from higher oil price. However, we are not restricting ourselves to industrial commodities but to agricultural ones too as they are vital for many economies. The higher price of cotton benefits India, while Coffee and orange juice benefit Brazil.

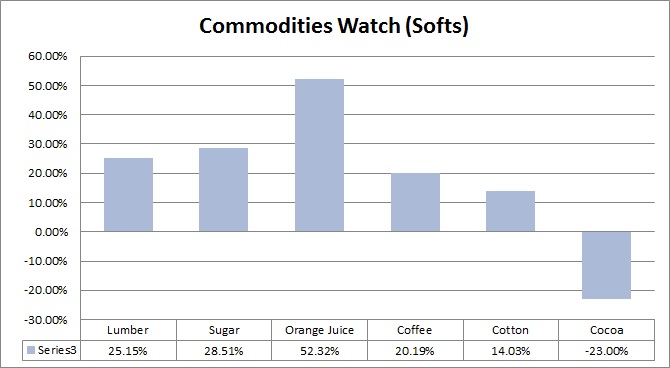

In this article, we evaluate the YTD performance of soft commodities, which are agricultural.

- The best performer in this pack has been Orange juice (52.3 percent), followed by Sugar 11# (28.5 percent), Lumber (25.1 percent), and Coffee (20.2 percent).

- Cotton price is up 14 percent this year on lower stocks and relatively higher demand.

- The worst performer in this group is Cocoa, which is down 23 percent.

The Soft commodities pack is one of the top performer this year with an average gain of 19.5 percent.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022