Cable is currently trading at spot 1.5389, we suggested strips last month as we were eying upon speculating opportunities because the pair has been oscillating on either direction since last May but for now it may show a little recovery from current positions so that our ATM delta calls should be ready to function, so keep doubling the ratio of call options. Cable is back to range bounded trend amid delta risk reversal inching into neutral figure.

GBP/USD has regained to catch the range bounded trend between 1.5704-1.5333, we had advocated currency option strategy 1st half of August as it had to suit range bounded circumstances and speculating opportunities with strangle shorting on low IV projections.

Option Strip Straddle:

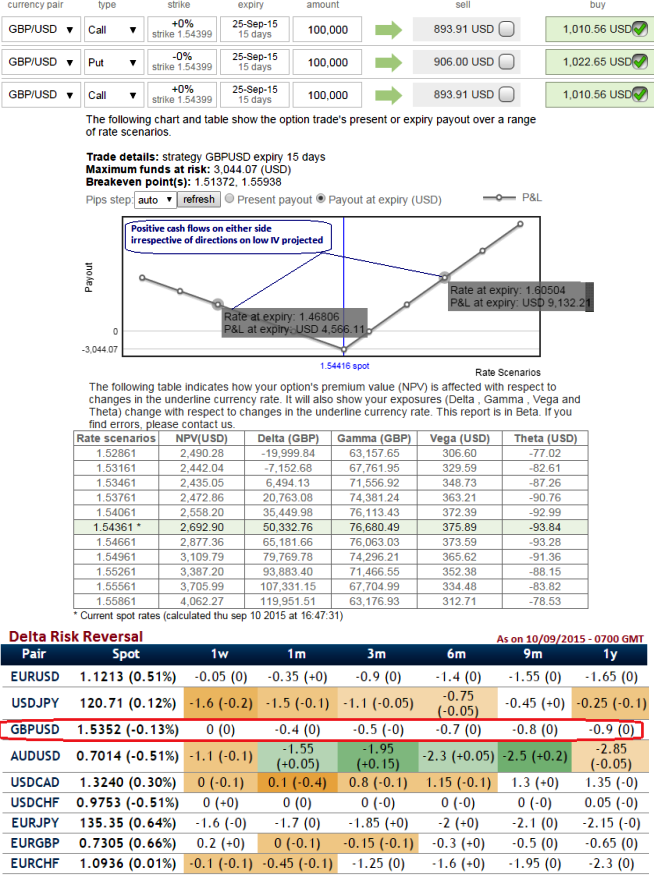

We now want to square off the positions in strips, book the profits and for now convert the same into strap on hedging grounds. So, Buy 15D At-The-Money delta put option and simultaneously buy 2 lots of 15D At-The-Money delta call options. Unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Net Debit = $3043.77

Combined Delta = 0.50

Maximum Profit = Unlimited

Profit = 2 x (GBPUSD FX spot - 1.5439 (strike of call)) - 3043.77 (net premium)

OR

1.5439 (strike of put) - GBPUSD FX spot - 3043.77 (net premium).

Thereby, we conclude stating since upside pressure is intensifying, more profitability on straps strategy has already been evidenced, Now is the time for our call to begin functioning as there is recovery mode is possible. So for those who reckon GBP's is to surge can accumulate these positions into their portfolios as calls functioning is likely event.

FxWirePro: Convert option strips into straps as cable’s delta risk reversal turns neutral – likely remain in range

Thursday, September 10, 2015 11:38 AM UTC

Editor's Picks

- Market Data

Most Popular