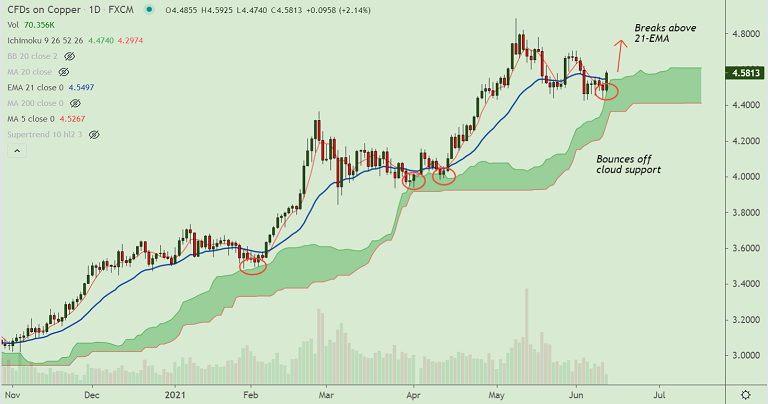

COPPER chart - Trading View

Technical Analysis: Bias Bullish

- Copper spikes over 2.30% on the day to hit 6-day high at 4.5925

- Price action has bounced off daily cloud support

- The pair has broken above 21-EMA which was capping upside from the past 5 days

- Price action has broken above 200H MA and 5-DMA has turned

- Stochs and RSI are showing a turn and RSI has edged above the 50 mark

Support levels - 4.549 (21-EMA), 4.420 (55-EMA), 4.372 (Cloud top)

Resistance levels - 4.585 (5W MA), 4.704 (Monthly high), 4.724 (Upper BB)

Summary: Copper trades with a major bullish bias. Pullbacks have found strong support at daily cloud. Retrace above 21-EMA have raised scope for upside resumption.