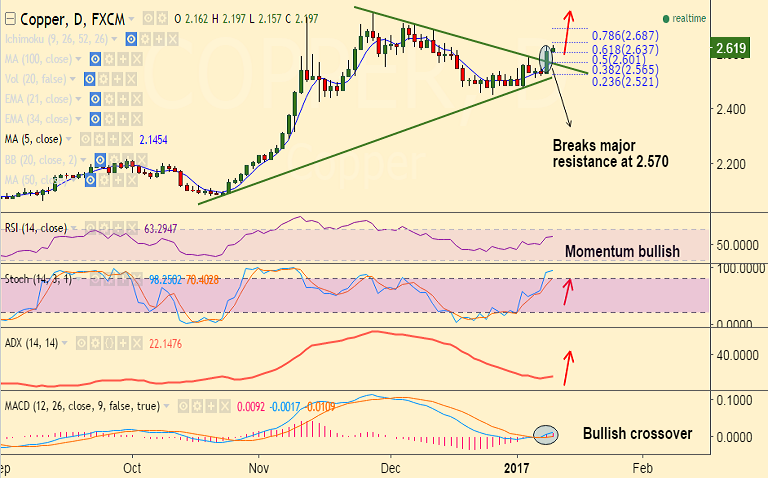

- Copper has broken above major trendline resistance at 2.570, bias higher.

- Technical indicators have turned bullish, scope for upside rises.

- MACD has shown a bullish crossover on signal line, momentum is bullish.

- ADX also has turned north, supporting current trend.

- Copper is currently struggling to extend gains above 61.8% Fib at 2.637.

- Break above to see test of 0.70 levels.

Major support - 2.60, (50% Fib of 0.752 to 2.450 fall), 2.5660 (5-DMA), 2.550 (Nov 30 low)

Major resistance - 2.637 (61.8% Fib), 2.687 (78.6% Fib), 2.70 (trendline)

Recommendation: Good to go long on dips around 2.60, SL: 2.5660, TP: 2.635/ 2.685/ 2.70