Refer Copper chart on Trading View

- Copper has retraced higher from multi-month lows at 220 levels.

- The pair is currently trading at 2.607, up 1.06% on the day.

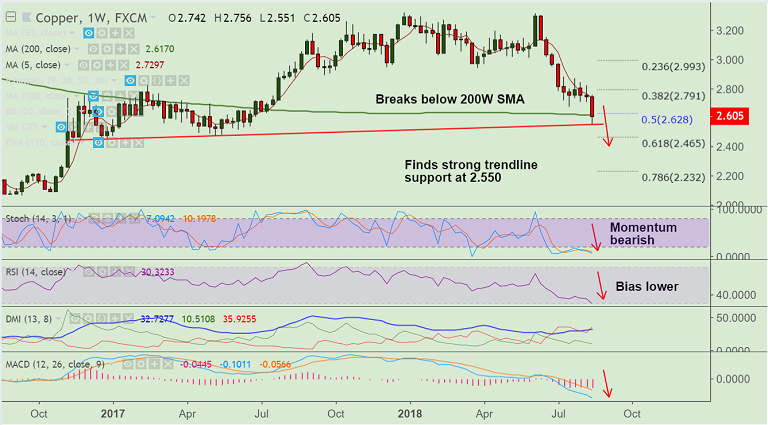

- Price action has dipped below 200W SMA and we see scope for further weakness.

- Momentum studies are bearish, RSI well below 50 and bias lower. MACD and DMI also support downside.

- We see strong trendline support at 2.550 mark. Violation there will see accentuation of weakness.

- Scope then for test of 61.8% Fib at 2.465 ahead of 2.232 (78.6% Fib).

- Retrace and close above 200W SMA could see consolidation. Breakout at 21-EMA could see further upside.

Support levels - 2.550 (trendline), 2.465 (61.8% Fib), 2.232 (78.6% Fib)

Resistance levels - 2.617 (200W SMA), 2.668 (5-DMA), 1.740 (21-EMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 35.1029 (Neutral) at 1045 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.