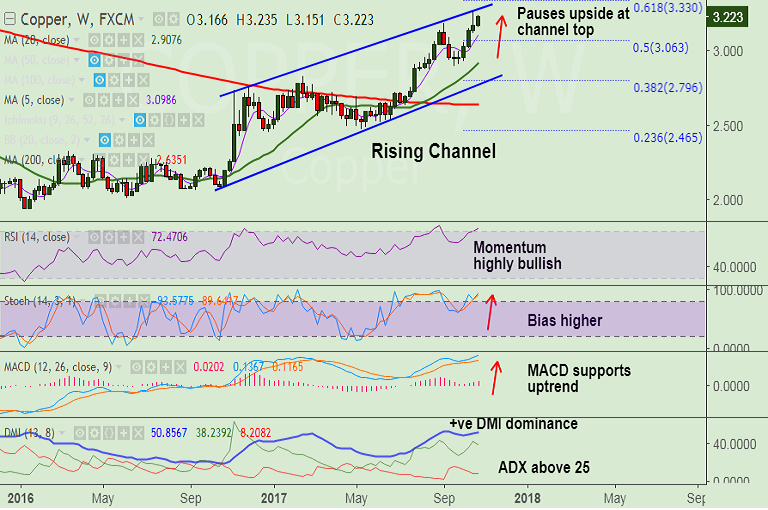

- Copper bulls are resuming upside, push prices higher after brief consolidation at multi-year highs.

- Trade extends in a rising triangle pattern and decisive breakout at channel top required for further upside.

- Technical studies support upside, momentum studies highly bullish, MACD and ADX support trend higher.

- Next major resistance lies at 3.285 (channel top) ahead of 3.293 (July 2014 highs) and then 3.335 (61.8% Fib of 4.20 to 1.936 fall).

- On the flipside, retrace below 20-DMA at 3.077 will see extension of weakness.

Support levels - 3.2, 3.182 (5-DMA), 3.077 (20-DMA), 3.0355 (cloud top)

Resistance levels - 3.255 (Aug 2014 high), 3.285 (channel top), 3.293 (July 2014 highs), 3.335 (61.8% Fib of 4.20 to 1.936 fall).

Recommendation: Watch out for channel breakout for further upside.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest