As per our recent anticipation, the hammer pattern at the bottom of downtrend at around 165.927 on daily chart, has evidenced a relief for interim bulls to reach our short term targets 169.194.

We continue to foresee further bearish travel from here onwards. It has already dropped to 163.98 thereby, it has reached our previous 1st target at 165 and is close to 2ndtargets at 163.500.

So thereby, by now previous shorts of At-The-Money put options with 3D expiries would have assured certain yields that you may have earned in the form of initial receipts of premiums on shorts. Now it is recommended to stay calm with long position in At-The-Money and Out of the money puts, even though the upswings are prevalent in short run, bearish turn may resume sooner.

But the previously shorted ATM shorts would have become out of the money and initial premiums would be assured returns.

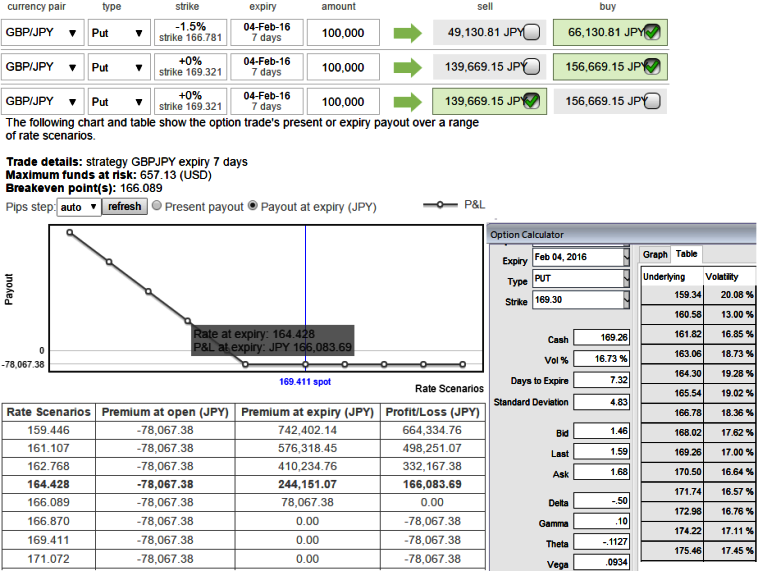

At the money -0.51 delta put option with 7 days expiry trading with IV at almost 16.73% has descent vega at 0.09 and gamma at 0.10 with IVs about 16.73%.

The Gamma is useful when using the underlying market to hedge options, since it gives an idea of how much more or less you need to hedge in the underlying market if the market price moves by 1%.

With reducing volatility gamma adds to the risk and reward profile for both holders and writers.

So, before these continued downswings may hamper your forex portfolio as we think the current downtrend holds stronger in long run, so we've tailored our formulation of strategies as the risk appetite varies from different investors to different traders.

Considering GBPJPY trend has been extremely conducive for bears in long term but short term rallies are also expected as we listed out series of bullish flags in our recent technicals that signifies luring upswings in short run and strong bearish trend in long run.

For now we urge for the targets at 165 and even at 163.500 levels are pretty much on the table upon holding the above stated resistance levels.

Hence, with hedging perspectives, using IVs, gamma and vega factors in order to neutralize volatility factor, put back-spreads are advocated so as to reduce the sensitivity and focus on hedging motive.

Hence, go long on 2W 1 lot of at the money -0.51 delta puts with gamma at 0.08, vega at 0.139, 1 lot of 1M (1.5%) out of the money -0.24 delta put and simultaneously risky speculators short At-The-Money put option with the narrow 2D expiries to reduce the cost of hedging by financing long position in buying At-The-Money Puts, as the upswings are prevalent in short run, these ATM shorts would sooner become out of the money and initial premiums would be assure returns.

FxWirePro: Cover shorts in GBP/JPY PRBS to book profits, stay calm with longs functionality

Thursday, January 28, 2016 8:32 AM UTC

Editor's Picks

- Market Data

Most Popular