WTI crude oil is declining for a fourth consecutive day on demand concerns. It hit a low of $80.83 at the time of writing and is currently trading at $81.63.

According to the American Petroleum Institute (API), crude oil inventories fell by 1.92 million barrels for the week ending July 5th 2024.

The cease-fire talks between Israel and Gaza will resume on Wednesday in Doha putting pressure on oil at higher levels. Hurricane Beryl had a very minor impact on Texas's energy production.

Major factors for crude oil price movement-

US dollar index (Bearish)- Positive for Crude.

Major resistance - 106.20/107.

Major support- 105.50/104.

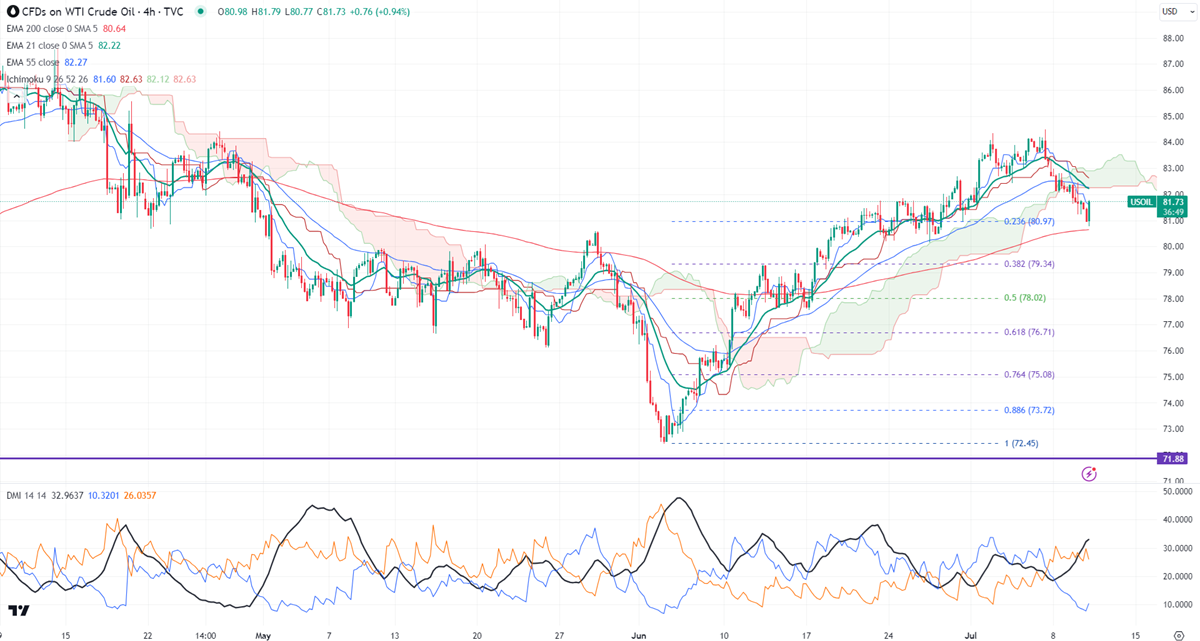

Ichimoku analysis (4- hour chart)

Tenken-Sen- $81.70

Kijun-Sen- $82.72

The immediate resistance is around $82.40. Any jump above the target of $83/$83.65/$84.50. On the lower side, near-term support is around $80.64. Any breach below will drag the commodity down to $80/$79.

It is good to buy on dips around $81 with SL around $80 for a TP of $85