- US oil has once again recovered after hitting low of $56.82 from that level after OPEC meeting. OPEC agrees to extend its production cut to end of 2018. The commodity recovered till $57.91 at the time of writing.

- The oil prices jumped almost 40% after OPEC and Russia planned to cut production by 1.8 million barrels per day.

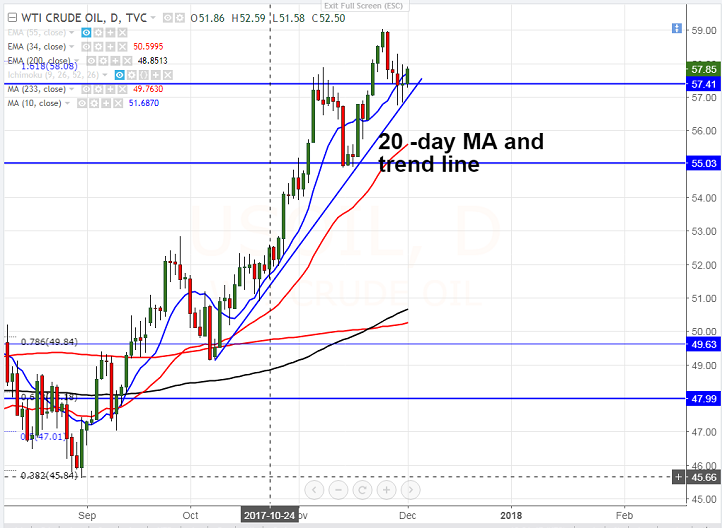

- The commodity has taken support near 20 –day MA ($56.79) and trend line ($56.71) at $56.74 and shown a minor jump from that level. Minor resistance is at $58.20 (61.8% fibo) and any break above will take the oil to next level till $59.05. Overall bullish continuation only above $59.05.

- On the lower side, any break below $56.70-75 (20- day MA and trend line support) and any break below will drag the commodity to next level till $56/$54.89 (Nov 14th 2017 low).

It is good to buy on dips around $57.40-45 with SL around $56.70 for the TP of $59.05/$60.