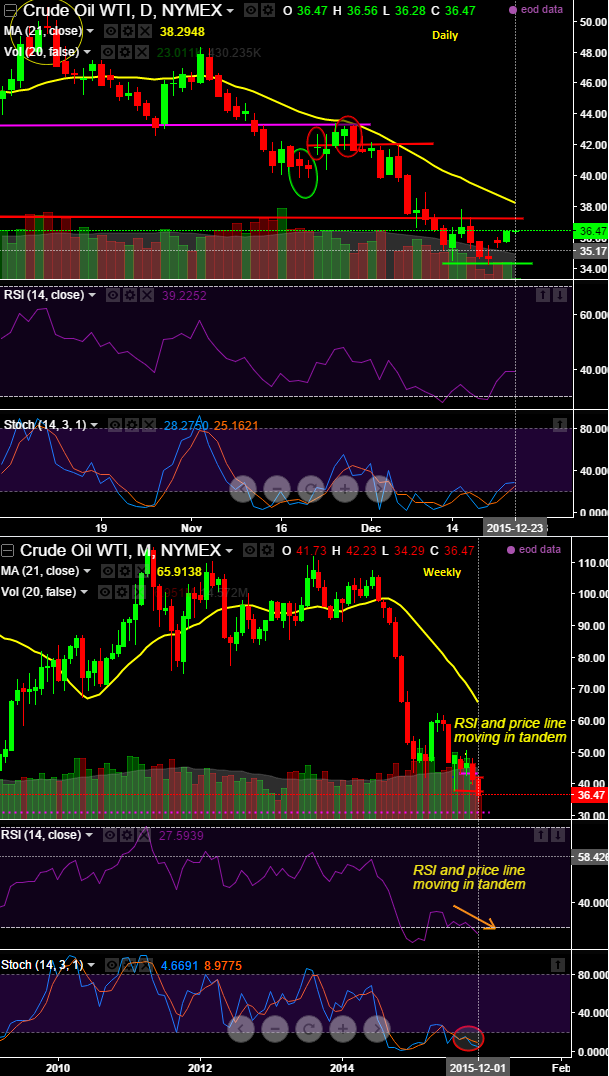

WTI crude has been struggling to beach resistance at 37.25 levels from last two weeks which has tested this level as strong support in the past (see blue colored circled area).

So, it may drag up to 34.25 if it fails to tumble below stated levels decisively.

The selling indications are bolstering as there seems to be a factor called volumes fading away. Hence, we reckon the previous rallies were only due to short coverings and certainly not to be regarded as bullish trend unless it breaks above resistance levels.

Although, daily RSI shows bullish convergence to the prices rises, monthly curve still signals more declines (currently RSI converging downwards below 30's on monthly while articulating).

While slow stochastic approached oversold territory but there are no convincing hints of bullish crossover (currently %D line at 8.9846 & %K line at 4.6905).

For now, we are bearish on this commodity and advisable to sell on every rally.

So overall we could foresee some more downward moves as the pair fails to hold onto above stated strong resistance. It is advisable to short futures at spot levels for immediate targets at 34.25 with strict losses at 37.75, thereby risk reward would be 1:2.

FxWirePro: Crude’s weakness to prevail below 37.25 - Short WTI crude for TP at 34.25 with risk rewards 1:2

Wednesday, December 23, 2015 11:15 AM UTC

Editor's Picks

- Market Data

Most Popular