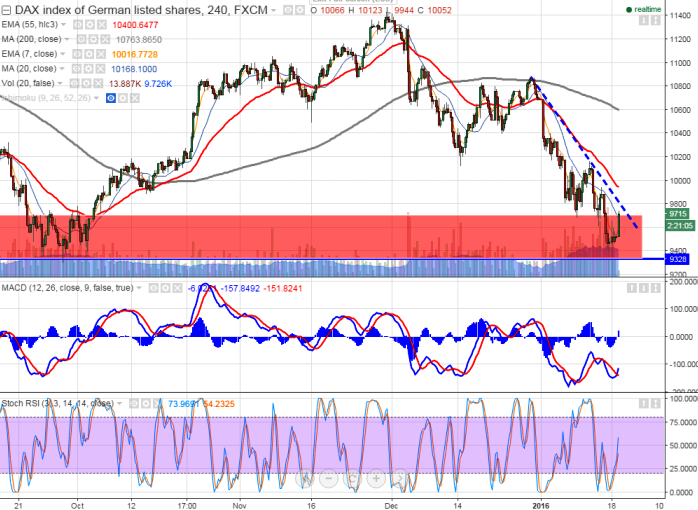

- DAX has recovered after making a low of 9417 yesterday. It is currently trading around 9725.

- The index is expected to jump till 9825 (trend line joining 10875 and 10164) and any further bullishness can be seen above this level. Above this level jump till 10000/10164 is possible.

- Short term trend is slightly bullish as long as support 9300 holds.

- Any break below 9300 will drag the index down till 9216/9120/9000.

- On the higher side minor resistance is around 9760 and break above targets 9825.

- Overall trend reversal only above 10200.

It is good to buy at dips around 9600-9625 with SL around 9400 for the TP of 9750/9825