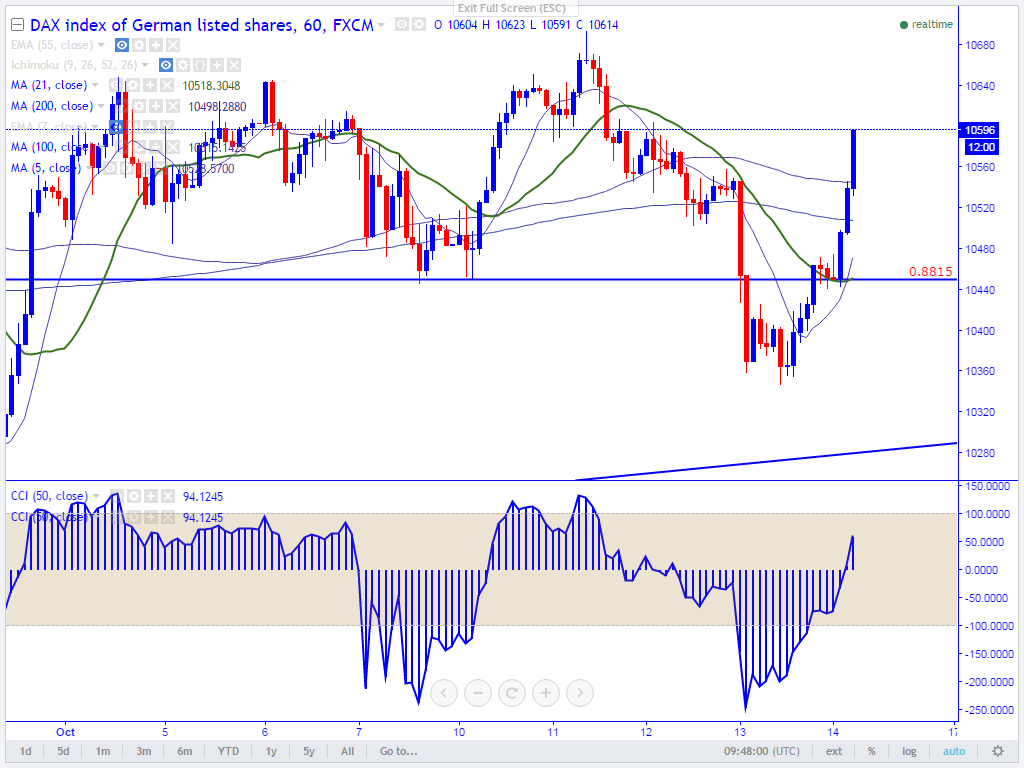

- Major resistance- 10547 (100- HMA).

- Major support - 10350 (61.8% retracement of 10093 and 10806).

- The index has taken support near 61.8% retracement and started to jump sharply from that level. It is currently trading around 10559.

- In the hourly chart ,the index is trading well above Tenkan-Sen (10450) and Kijun-Sen (10461).It has also broken 200-HMA level (10515).Short term trend is slightly bullish, a jump till 10700/10806 is possible.

- On the lower side, support stands at 10450 and any violation below will drag the pair till 10350/10300 (trend line joining 9302 and 10182).

It is good to buy on dips around 10540 with SL around 10445 for the TP of 10705/10806.