- DAX index hits low of 11905 and shown a minor jump from that level. The index is expected to show a good recovery as S&P500 and Dow Jones formed a minor bottom and shown a good recovery. Dow and S&P futures continuing its uptrend and is trading 0.5% up. Short term trend is slightly bullish and a jump once again till 2700 is possible. Overall weakens can be seen only below 2530 level.

- DAX index recovered almost 400 points 3.21% from low of 11905 and has closed around 12215.

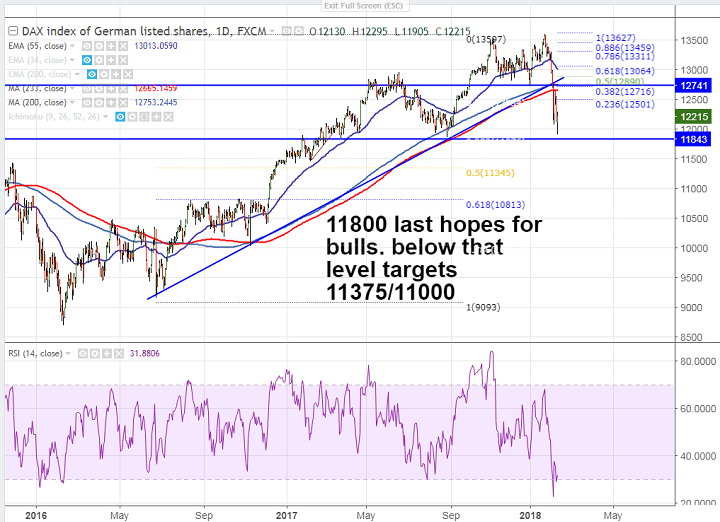

- The minor bullishness can be seen only if it closes above 12660 (233- day MA) and any close above will take the index to next level till 12890/13050 (100- day MA). It should break above 13600 for further bullishness.

- On the lower side, near term major support is around 11800 and any break below will drag the index till 11400/11000.

- In the daily chart momentum indicator shows oversold zone and a minor jump is possible.

It is good to buy on dips around 12100-150 with SL around 11800 for the TP of 12640.