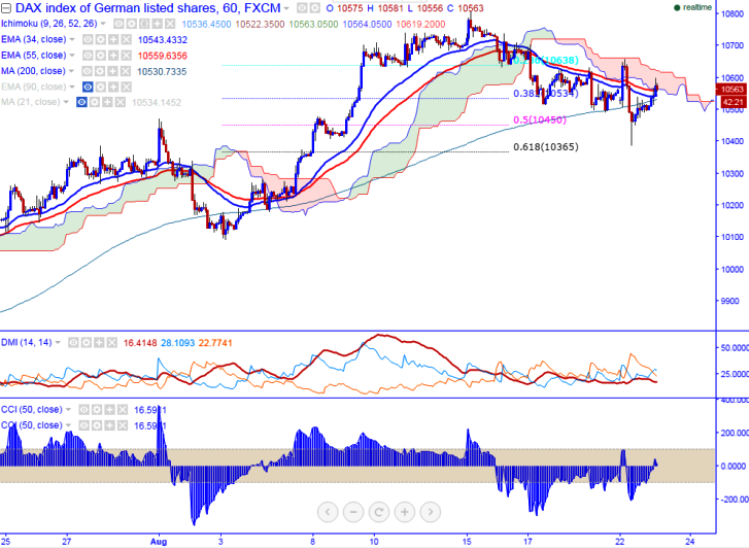

- Major support – 10365 (61.8% retracement of 10093 and 10806).

- The index has declined till 10386 and regained sharply from that level and is currently trading around 10572.

- In the hourly chart, DAX is trading slightly above Tenkan-Sen (10522) and Kijun-Sen (10534).It should close above cloud bottom (10625) for slight jump till 10806.

- Any break below 10528 (200 HMA) will drag the index down till 10365 (61.8% retracement of 10093 and 10806).Minor weakness can be seen only below 10365 and break below targets 10200/10095 in the short term.

- On the higher side, any break above 10630 will take the index to temporary top around 10806 and it should close above 10806 for further up move.

It is good to sell on rallies around 10630-650 with SL around 10810 for the TP of 10455/10365/10240.