- DAX index shown a good recovery yesterday after hitting low of 11730 and closed well above 12000 1.42% higher. US markets has shown a minor recovery from the low Dow (1.37% higher) and S&P500 (1.10% higher) on easing US trade war. S&P500 futures is trading flat after hitting high of 2727 .It is trading at 2717.9 0.03% lower. Asian stock indices are trading higher on the footsteps of US markets.

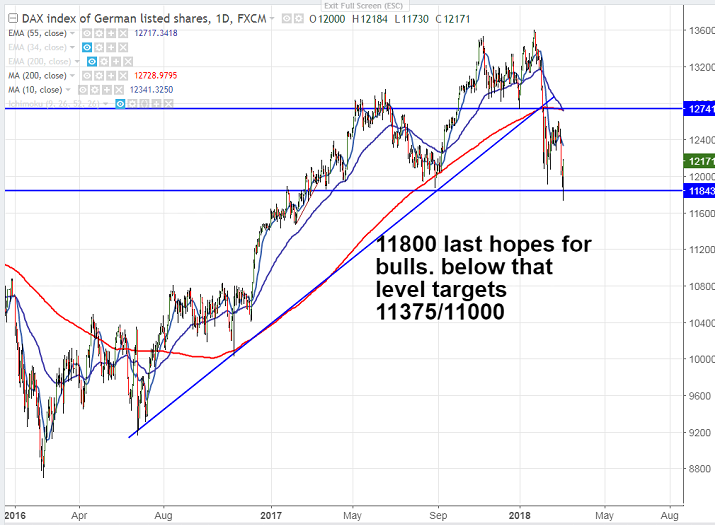

- DAX index has broken previous low of 11905 made on Feb 9th 2018 and declined till 11730. The index recovered almost 500 points from the low of 11730.

- The minor bullishness can be seen only if it closes above 12289 (5- day MA) and any close above will take the index to next level till 12363/12500. It should break above 12660 for further bullishness.

- On the lower side, near term major support is around 11800 and any close below will drag the index till 11400/11000.The minor support is around 12000.

It is good to buy on dips around 12000-050 with SL around 11730 for the TP of 12420/12660.