- DAX index has closed slightly on the downside yesterday nearly 0.77% lower. But Dow and S&P rose slightly on Tuesday for the third consecutive days. Market waits US Consumer price data to be released today for further direction.S&P500 futures is showing a minor jump from yesterday close around 0.12%. . It is trading around 2664 0.12% higher. Minor trend reversal happen if it breaks above 2725 level. Overall weakens can be seen only below 2530 level.

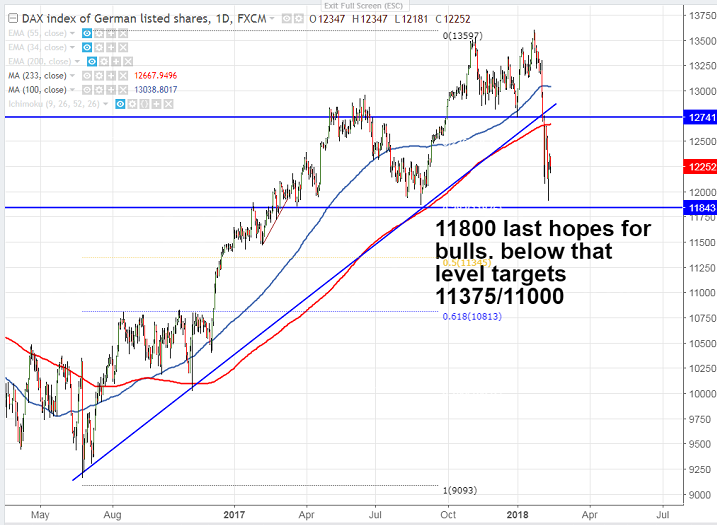

- DAX index declined till 12181 and is currently trading around 12252. The world biggest hedge funds has taken short position against European equities valued more than $14 billion.

- The minor bullishness can be seen only if it closes above 12660 (233- day MA) and any close above will take the index to next level till 12890/13050 (100- day MA). It should break above 13600 for further bullishness.

- On the lower side, near term major support is around 11800 and any break below will drag the index till 11400/11000.

It is good to sell on rallies around 12450-500 with SL around 12700 for the TP of 12000/11800.