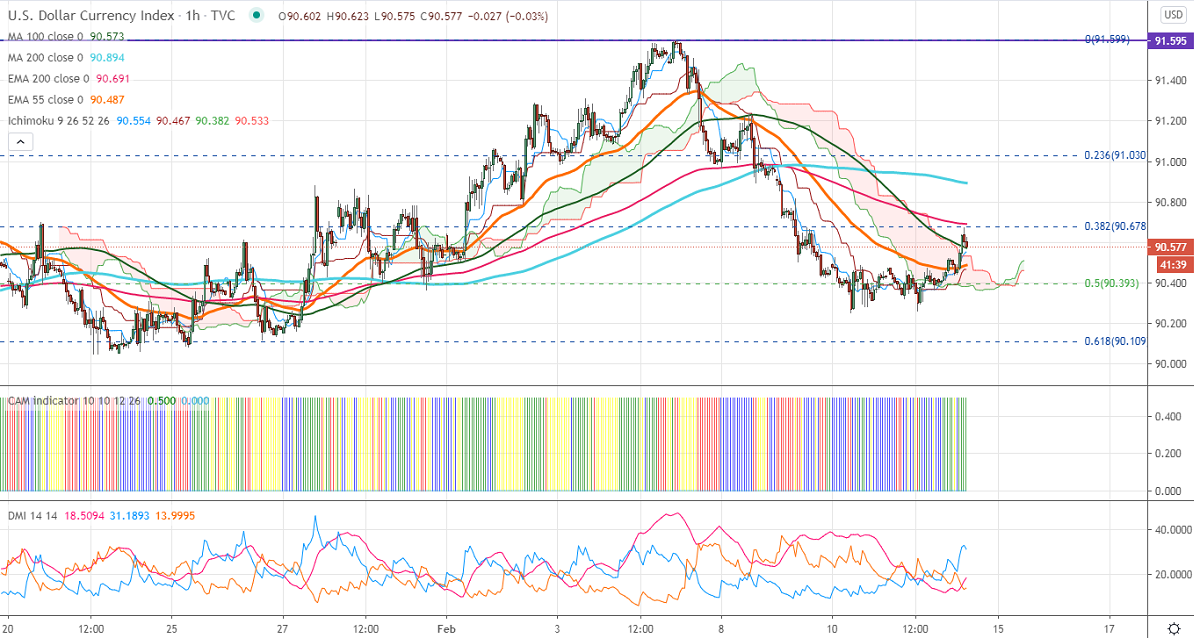

Ichimoku Analysis (14-Hour chart)

Tenken-Sen- 90.54

Kijun-Sen- 90.46

US Dollar index has formed almost a double bottom near 90.25 in the hourly chart and shown a nice recovery. The upbeat market sentiment, hopes of more fiscal stimulus, and weak US jobs data are putting pressure on the US dollar at higher levels. The number of people who have filed for unemployment benefits rose to 793000 compared to a forecast of 76000. Continuing claims benefits declined by 145000 to 4.54 million. Markets eye US University of Michigan sentiment data for further direction. The index hits an intraday high of 90.67 and is currently trading around 90.620.

The near term resistance is around 90.70 convincing close above confirms minor bullishness. A jump to 91/91.60 likely.

The index facing strong support at 90.25; any indicative break below will take the index to 90/89.20/88.53.

It is good to buy on dips around 90.25-30 with SL around 90 for a TP of 91.60.