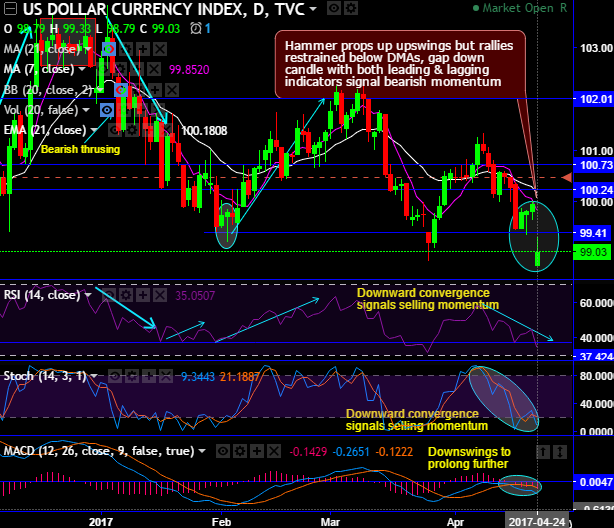

For today, gap down candle has occurred at 98.79 level but bulls slightly managed to recover the losses upto the current 99.15 levels, the rallies are extended today as well upto 99.33 levels but these upswings are not substantiated by both momentum and trend indicators on this timeframe. Instead, we could see bearish DMA and EMA crossovers on daily and weekly charts.

The US dollar index forms hammer pattern candlestick at 99.84 levels, historically, the bulls test the support at the same levels and the same bullish pattern has occurred to the evidence the upswings upto the peaks of 102.26 levels. But these upswings were restrained at DMAs (refer daily charts).

Well on medium-term perspective, Gravestone doji & shooting stars evidence more slumps upto next strong support at 98.91, leading & lagging indicators signal momentum & downtrend continuation (refer weekly chart).

Both RSI and stochastic curves evidence downward convergence with the prevailing slumps.

MACD on both timeframes signals bearish trend to prolong further.

Fundamentally, the US administration, on the other hand, has returned to its tax plans. Treasury Secretary Mnuchin promised last night that there will be far-reaching reforms before the end of the year. The FX market no longer pays much attention to these promises.

Neither had the government so far convinced in other key areas nor do we have sufficient knowledge as to which way the tax reform would go.

While the FxWirePro currency strength index for the dollar has been feeble as the euro surged on earlier Monday in Asia after an predictable outcome for the French elections that led to a runoff between centrist Emmanuel Macron and far-right leader Marine Le Pen., despite relinquishing its gain for the day for the previous week after gaining traction found in bullish pattern as stated above but the overall dollar basket is still weaker after today’s gap down, was dropped about 0.83% to 99.15 (while articulating).

For more details on our index please visit below weblink: