Daily Commodity Tracker (12:30 GMT)

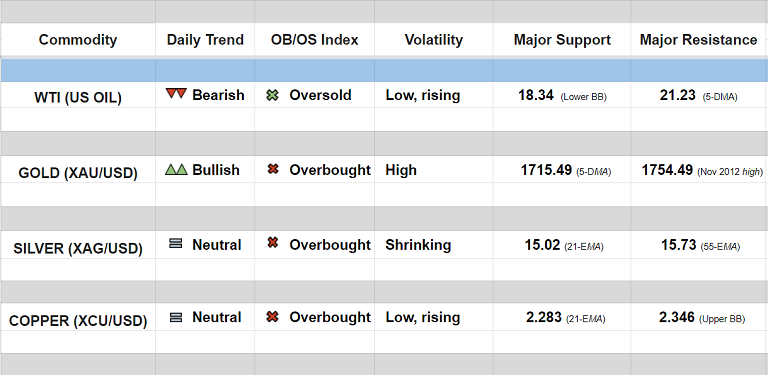

WTI (US OIL):

Major and Minor trend - Strongly bearish

Oscillators: Oversold, bias lower

Bollinger Bands: Volatility Rising on Daily, Weekly and Monthly charts

Intraday High/Low: 20.61/ 19.93

GOLD (XAU/USD):

Major and Minor trend - Strongly bullish

Oscillators: At overbought

Bollinger Bands: Volatility Rising on Weekly and Monthly charts

Intraday High/Low: 1738.669/ 1712.016

SILVER (XAG/USD):

Major trend - Neutral; Minor trend - Turning neutral

Oscillators: At overbought (on verge of rollover)

Bollinger Bands: Volatility Rising on Weekly and Monthly charts

Intraday High/Low: 15.60/ 15.30

COPPER (XCU/USD):

Major and minor trend - Neutral

Oscillators: At overbought (On verge of rollover)

Bollinger Bands: Volatility Shrinking on Daily charts, Rising on Weekly and Monthly charts

Intraday High/Low: 2.316/ 2.285

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms