Daily Commodity Tracker (11:30 GMT)

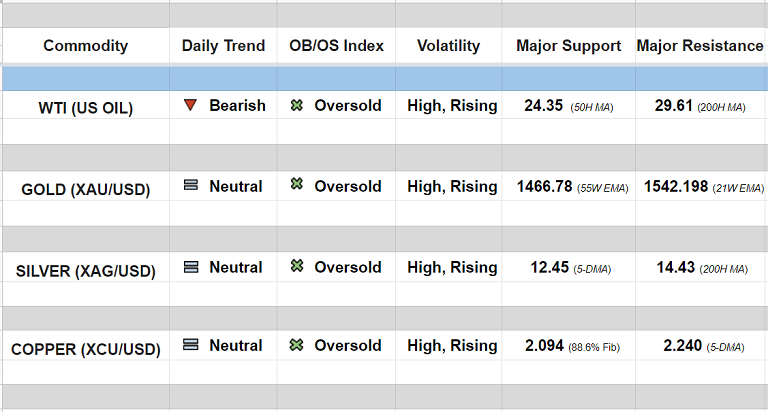

WTI (US OIL):

Major - Strongly bearish; Minor trend - Turning neutral

Oscillators: Oversold (on verge of rollover into neutral)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 28.46/ 25.71

GOLD (XAU/USD):

Major trend - Neutral; Minor trend - Turning neutral

Oscillators: Oversold (on verge of rollover into neutral)

Bollinger Bands: Widening on Daily charts

Intraday High/Low: 1516.180/ 1455.320

SILVER (XAG/USD):

Major - Strongly bearish; Minor trend - Turning slightly bullish

Oscillators: Oversold (turning north)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 13.0288/ 11.9954

COPPER (XCU/USD):

Major - Strongly bearish; Minor trend - Turning neutral

Oscillators: Oversold (on verge of rollover into neutral)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 2.235/ 2.092

FxWirePro: Daily Commodity Tracker - 20th March, 2020

Friday, March 20, 2020 11:49 AM UTC

Editor's Picks

- Market Data

Most Popular

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges