A delta neutral trading strategy in this case involves the buying of a theoretically underpriced option (OTM as shown in the diagram) while taking an opposite position in EURCHF options.

Well, thereby, a common question pops up after this explanation, "How do I know if an option is theoretically underpriced?" I prefer to use Option Greeks platform that provides this information.

Comparing reasonable delta contents, ATM IVs and option premiums with net present values of such premiums, will give you the theoretical price of an option.

Here, the implied volatilities of ATM contracts are below 8% for next 3 months tenors.

So if anyone believes it can still be possible to pull out returns from this dubious scene from this pair, even though exhausted bulls who think long lasting non-stop streak of bull run to take halt at this point. Yes, that's quite achievable from iron butterfly strategy.

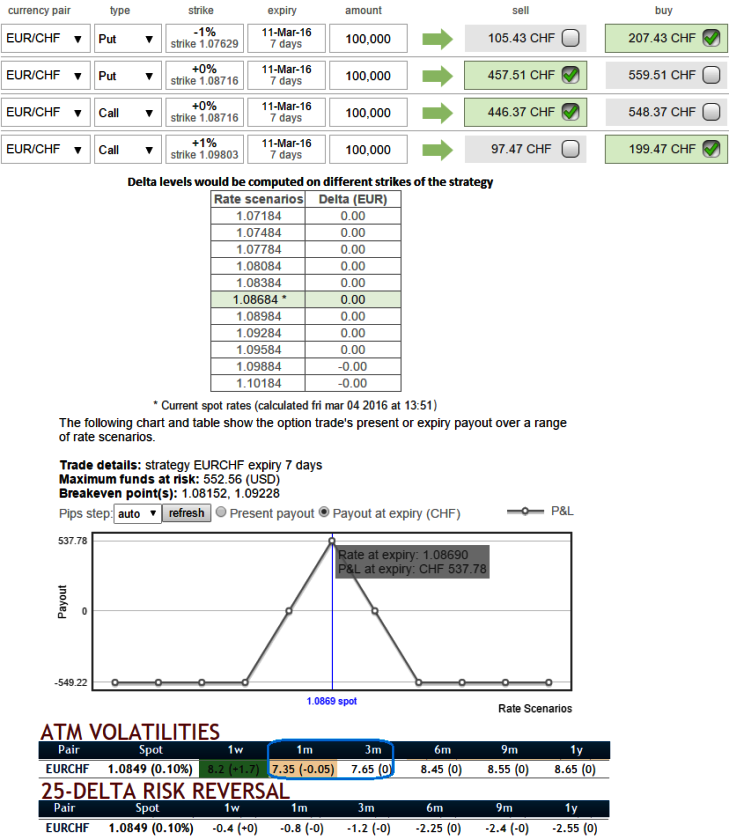

To execute this strategy, the option trader assumes long on a lower strike Out-Of-The-Money put and shorts At-The-Money Put simultaneously short again on At-The-Money call and long on Out-Of-The-Money call, this results in a net credit to put on the trade.

At Spot ref: 1.0872, iron butterfly strategy (EUR/CHF) can be executed as shown below,

Long 2M (1%) OTM -0.26 delta Put (strike at around 1.0762) & Short ATM Put with positive theta + Short ATM Call with positive theta again & Long 2M (1%) OTM 0.27 delta call (strike at around 1.0980).

In iron butterfly, there is high probability of deriving certain yields as it contains both bull call and bear put spreads, hence it would likely yield variant payoffs from classic butterfly spreads.

Please be noted that the expiries and strikes used in the diagram are only for demonstration purpose, use appropriate inputs as stated above.

FxWirePro: Delta neutrality in 1M EUR/CHF iron butterfly likely to earn certain yields

Friday, March 4, 2016 9:00 AM UTC

Editor's Picks

- Market Data

Most Popular