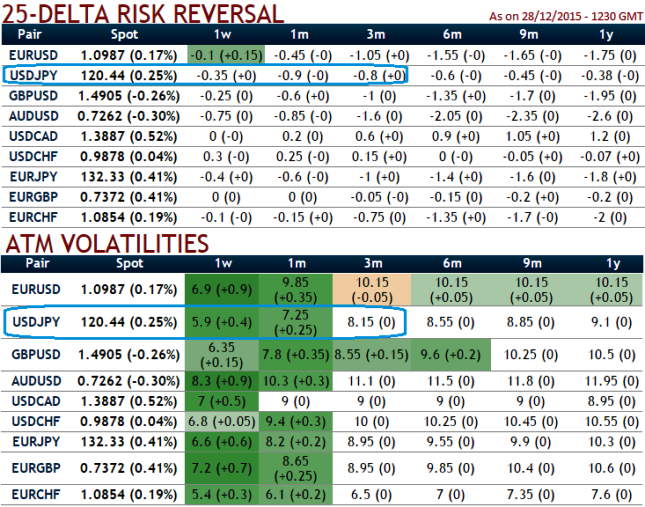

The 25-delta risk reversals of USDJPY and EURJPY are still at the higher negative values among entire G7 currency space for next 1-3 months, but we think some short upswings could be exploited for shorts.

This would mean that market sentiments for this pair have been bearish for these pairs are bearish in long run despite eyeing on any abrupt upswings for shorting opportunities. As a result, we reckon that for next 3 months' time Yen may pretty much gain out of lots of manipulations and ambiguities are surrounding around dollar.

On the other hand, it is also understood that ATM contacts of USDJPY have gradually reduced implied volatilities after the much awaited fed's season which has evidenced anticipated rate policy that was factored in already and has propped up a little leftover strength in dollar soon after the event.

For now, yen's gains in medium run are very attractive, you get to know that from OTC markets positions and order flow basis, it seems that fed hike of 25 bps has already been fairly positioned and priced in especially hard currency pairs such as USDJPY.

The pair is likely to perceive implied volatility close to 7.25% for next 1 month, accordingly last week we had recommended deploying short put ladder spreads that contains proportionately less number of shorts and more longs which would take care of potential slumps on this pair and significantly higher volatility times.

Since implied volatility is inching higher again which is good for option premiums and 2 lots of ATM longs are very much on the handsome yields as the underlying pair has dropped from last week's 121.505 to 120.092 this week.

The recommendation for now is to stay calm with these existing positions as the underlying pair is having more potential on downside.

FxWirePro: Delta risk reversals signify USD/JPY long-term weakness - longs in put ladders are on functionality

Tuesday, December 29, 2015 7:01 AM UTC

Editor's Picks

- Market Data

Most Popular