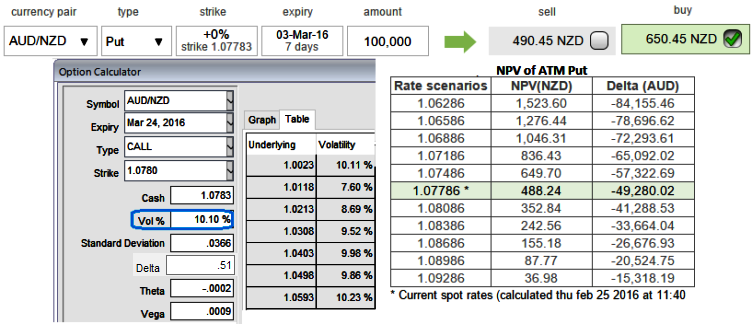

Implied volatilities for ATM contract of AUDNZD with 50% delta and 1M tenor are trading just shy below 10%, volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

The current spot FX is trading at 1.0775 while articulating, as we conduct technical analysis on this pair in our recent write up, from here onwards we expect dips extending up to 1.0570 levels in near terms. It is understood that bearish momentum is bolstering as we saw that from technical indicators.

But, from the diagram you can very well make out there exists an absolute disparity between ATM premiums and IVs which mean these overpriced premiums are less likely to expire in the money. Contemplating all these things in mind in conjunction with risk appetite, cost factor below strategies are advocated.

Put Ratio Back Spread: AUD/NZD

Spread ratio: (Longs 2 ATM + OTM : Short 1 ITM)

Unlike a simple naked put, put back spreads have an extra long that has not only leveraging effects.

A short option at a lower strike that caps your reward but also reduces the net cost of the trade.

So, the recommendation for now is to add an extra long on put with 1W expiry to the existing debit put spreads which would consist an out of the money put. Aggressive bears can initiate strategy using ATM puts in addition.

With these narrow strike differences, the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement. You want to take this trade if you think this pair can go lower, but not crash below 1.0570 in short run (no harm on short side of the ITM put). Use longer tenors on long side as NZD may gain in longer run and shorter tenor on short side for time decay advantage.

Caution: If you think the pair is going to crash, you should be loading up on put buys in existing strategy. The total cost of the trade is going to be the difference between the prices of the two options.

Since the option you sell will always be lower on the skew curve it means you are getting a better deal on what you are selling compared to what you are buying. It makes this strategy a good one if the skew is running a little hot but EURJPY hasn't rolled over that much.

Alternatively, one can even think on 3-Way Options straddle versus Call as the IVs are on lower side.

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: Go long 3M At the money delta Call, Go long 6M at the money delta put and simultaneously, Short 3M (1.5%) out of the money call with positive theta.

FxWirePro: Deploy 3 way straddle vs call as AUD/NZD stable IVs, PRBS for reduced hedging cost of downside risks

Thursday, February 25, 2016 6:38 AM UTC

Editor's Picks

- Market Data

Most Popular