Geopolitics in Europe is lingering across the eurozone, with German Chancellor Merkel’s coalition under pressure again on immigration issues. The UK PM Theresa May is hosting her cabinet at Chequers to hammer out an agreed post-Brexit position that is in the limelight. After Mr Seehofer (CSU, Mrs Merkel’s Bavarian sister party) offered to step down as party leader and Interior Minister, the quarrel between Mrs Merkel’s CDU and the CSU escalated, and a government breakup is not off the table.

Nonetheless, during trade in Asia, the EURUSD exchange rate has barely been impacted by the political turmoil in Germany. Luckily, political crises are not economic crises.

On the data front, we get UK manufacturing PMIs, the headline index increased to 54.4 in May, supported by a notable rise in the output component, although growth in new orders slipped slightly. UK’s June service PMIs is forecasted to surge 54.5 from previous 54 levels that could match this year’s highs.

In addition, the release of the BoE’s latest Financial Stability report yesterday this week highlighted the material risks of a disruption to financial services from Brexit, a finding that is at odds with the rather more insouciant attitude of a hawkish-leaning MPC and also the front-end of the UK curve (which prices a 2/3 chance of an August hike).

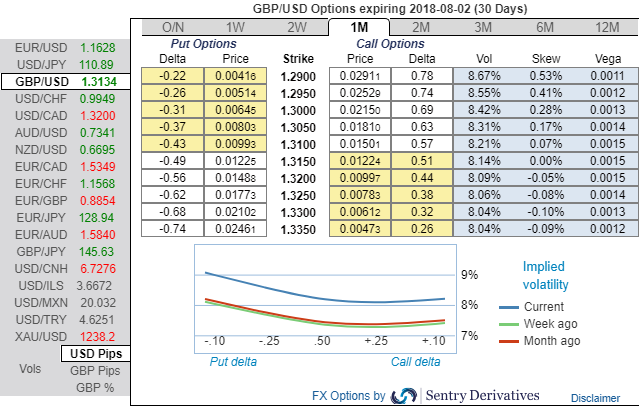

All these bearish driving forces seem to be factored-in OTC markets. Please be noted that the positively skewed IVs of 1m tenors signify the hedgers’ interests to bid OTM put strikes upto 1.29 levels (refer above nutshell evidencing IV skews).

Although you can observe risk reversal numbers of cable (GBPUSD) that signals bearish risks remain intact (refer above nutshell showing risk reversals).

Hence, we keep a vestigial option short in cable through a 1m put RKO. We will collect time decay from the RKO assuming cable is held in check close to the 1.31 strike over the next few weeks by the conflicting forces of less impressive US data and a continued lack of progress on Brexit. The next potential Brexit flashpoint focus will be the cabinet offsite next Friday at which the PM will once again attempt to hammer out a common government position on customs policy, the single market, and associated Brexit red-lines.

Square off cable’s any short positions in spot trades for a considerable return. While Activate a 1.31 GBPUSD put, RKO 1.28 expiry 27 July. Paid11.5bp, marked at 10bp. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 48 levels (which is bullish), while GBP is flashing at -16 (which is neutral) while articulating at (05:25 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One