The USD index is only a modest 0.4% stronger and EURUSD -0.8% weaker, both still within ranges since October, and only six currencies have moved more than 1.5% against the dollar. If the Euro area disappoints sufficiently, this anti-cyclical appreciation in the dollar might also extend to another leg down in EURUSD (our 1Q'19 forecast of 1.11 already allows for a certain probability of this).

On a broader perspective, we view EURUSD’s seesaw sentiments on either side in especially the short-run, but at 1.12-1.08 as a major support region and the ideal area for a long-term higher low over the 1.0340 lows set in 2016.

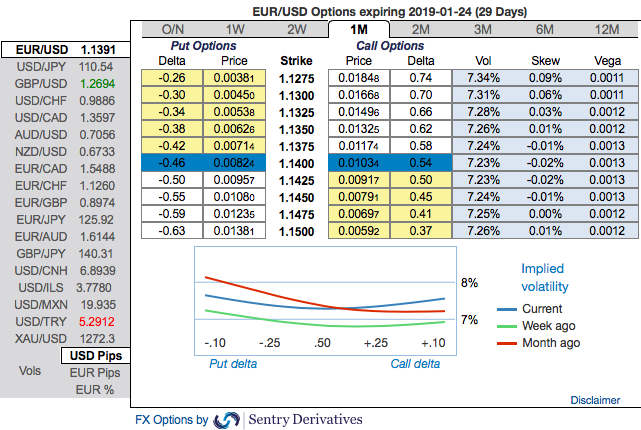

FX Derivatives Strategy (EURUSD): Options Strips

Combination ratio: (2:1), spot reference: 1.1384

Rationale: You could easily make out that EURUSD skews have been well-balanced on either side in 1m tenors that signifies hedgers interest in both OTM put and OTM call options. Whereas the bid for OTM puts of 3m tenors signal extreme bearish risks.

To substantiate these indications, the RRs for negative bids in the 3m and neutral numbers for 1m tenors also indicate us directional trading strategies.

Contemplating the prevailing bearish technical environment (in long-term) and most importantly, the positively skewed IVs in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with the bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, go long 1m at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Alternatively, shorting futures of mid-month tenors are advocated with a view of arresting further potential slumps. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -31 levels (which is mildly bearish), while hourly USD spot index was at 37 (mildly bullish) while articulating (at 10:41 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand