The main move yesterday was the euro’s fall which reflected the ECB’s caution about the inflation outlook, despite upward revisions to economic growth forecasts.

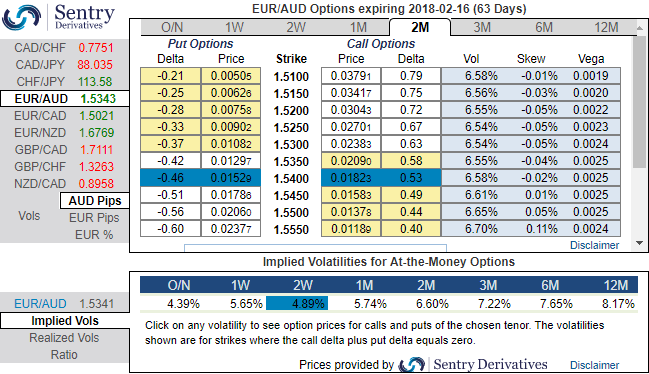

OTC Outlook and Options Strategy: In the case of optionality, the skews of 2m implied volatilities are projected to spike above the current realized (refer above nutshell), while the positively skewed IVs indicate bidding for hedging upside risks in the underlying spot (upto 1.5550).

Technically, the risk is essentially pricing in the bearish case in the short-medium trend but the major uptrend remains intact, as it is linked to the possibility of volatile Aussie spikes. We articulate the euro’s technical trend against the Aussie dollar in our recent post (refer the same in our technical analysis section).

Thus, contemplating all the above underlying factors of EURAUD, we like being short vol in short run, selling that premium conditionally on a pay-off benefiting from a lower spot.

At spot reference: 1.5358, prefer a ladder to a call spread ratio as we expect slumps to continue in short run and limited spot appreciation and topside volatility, accordingly buying a 2m call ladder are recommended. Buy 1 ITM Call of 2m tenor, simultaneously stay short in 1m 1 ATM Call and Sell 1 OTM Call of positive thetas (strikes 1.5153/spot/1.5678).

That structure improves the odds compared to a call spread ratio as the maximum and constant profit zone is reached over a range instead of a single spot level.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -100 (which is bearish), while hourly AUD spot index was at 77 (bullish) while articulating (at 09:51 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios