Macroeconomic Fundamentals:

Swiss manufacturing PMIs prints upbeat numbers at 54.2 against forecast at 53.6 and previous 53.2.

This upbeat number has indicated the economic health and how businesses are likely to react quickly to the market conditions, and also divulges a relevant insight into the economy.

While, next week Switzerland’s unemployment rate is lined up for announcement, Swiss unadjusted unemployment rate decreased slightly to 3.6% in March of 2016 from 3.7% in the previous month which is in line with expectations.

Switzerland's economy grew by 0.4% in Q4 of 2015, as compared to a revised 0.1% contraction reported in the previous quarter and beating market consensus. It is the strongest expansion since the fourth quarter of 2014.

Technical Glimpse:

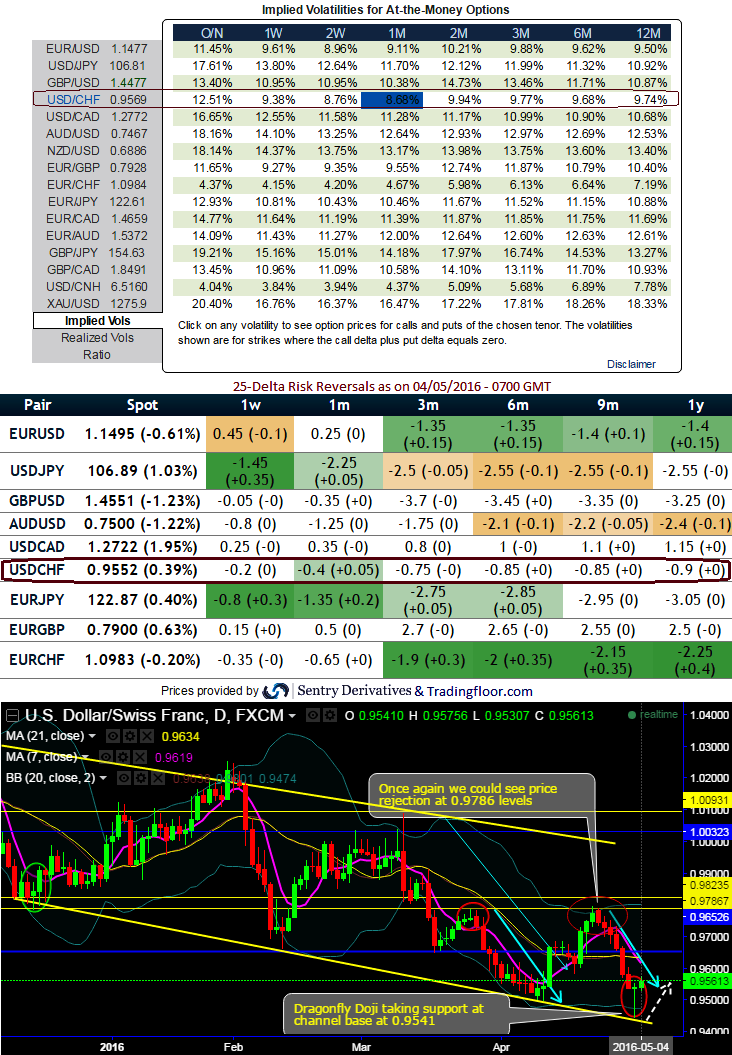

“Dragonfly Doji” pops up on daily and bearish engulfing weekly charts. The pair has rejected stiff resistance at 0.9786 levels, as a result, continuous bear streaks were seen, but it has now shown a little sense of recoveries (the lower tail of dragonfly candle). Overall, 7DMA crosses below 21DMA major trend puzzling but intermediate trend has been bears favour.

Hedge to Arrest Uncertain Fx Risks With Reduced Costs:

Margin: Not needed for Calls

Execution: Go long in 2M (0.75%) ITM +0.67 delta call, and simultaneously short 1W (1%) OTM call with preferably positive theta or closer zero.

The Delta is continuously varying as the underlying spot FX fluctuates. Options further in-the-money (ITM) have a higher Delta. This indicates that ITM options are worth more per pip movement in the underlying market and out-the-money options are worth less per pip.

Strategy run-through:

One can use this strategy upon the expectation of trading or even on hedging grounds that the underlying spot FX USDCHF would rise in long run but certainly not with drastic pace in short run. Even if it goes against, the maximum loss is limited by OTM strike price. having shorts in this strategy capitalize on reducing vols and initial premiums that we receive would finance for long position.

Risk/Reward Profile: The profit is limited by OTM strike price, No matter how far the market moves above, the profit remains the same.

The maximum loss is the net premium paid (for Calls) and is achieved when the underlying market moves below ITM strike. A smaller loss is made between ITM strikes and the break-even point.

Impact of volatility factor: The 1W ATM IVs of this pair is at 12.51% which is good for short that we’ve recommended, No significant effect is expected since we have dual leg in our strategy.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns