We kept stating that yen's gains in long run, you get to know that from OTC markets positions and order flow basis, it seems that fed hike of 25 bps has already been fairly positioned and priced in especially hard currency pairs such as USDJPY.

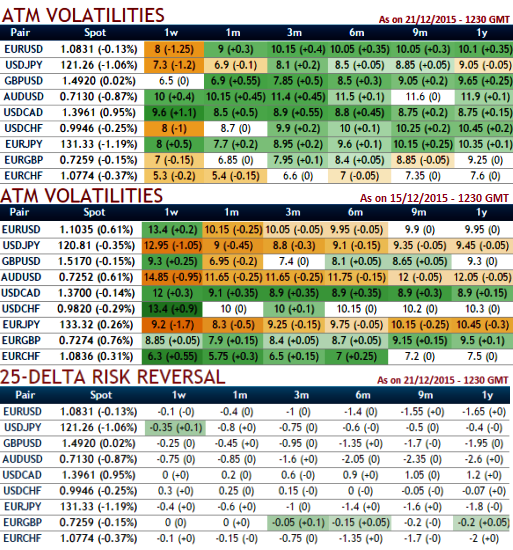

It is also understood that ATM contacts of USDJPY have gradually reduced implied volatilities after the much awaited fed's meet which has evidenced anticipated rate policy that has propped up dollar's strength (see and compare current IVs of 1w & 1m contracts with the last week's contracts).

On the other hand, delta risk reversal for currency crosses dealing with JPY is still highest negative values among entire G7 currency space for next 1-2 months, but we believe some short upswings may be utilized for shorts. (Compare delta risk reversal with last week).

This would mean that market sentiments for this pair have been bearish for this pair. As a result, we reckon that for next 2 months' time Yen may pretty much gain out of lots of manipulations and ambiguities are surrounding around dollar.

The pair is likely to perceive implied volatility close to 7.3% and it is likely to reduce for 1M ATM contracts that has reduced at 6.9% from last week's 9%, thus we recommend deploying short put ladder spreads that contains proportionately less number of shorts and more longs which would take care of potential slumps on this pair and significantly higher volatility times.

So, short ITM put with shorter expiry since implied volatility is inching higher which is good for option writers and buy 2 lots of ATM and OTM put with longer expiry.

FxWirePro: Deploying USD/JPY put ladder serves hedging motives in sideways but slightly bearish trend

Monday, December 21, 2015 6:30 AM UTC

Editor's Picks

- Market Data

Most Popular