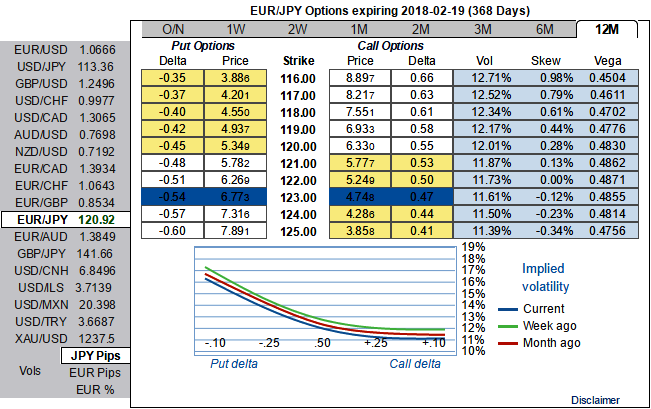

The EURJPY volatility surface is currently offering very attractive opportunities, as ATM volatility is rich and 6m/1y skews are excessively priced. Here, we recommend a couple of trades taking advantage of both the volatility and skew premiums.

In the volatility space, going short a 6m variance swap provides extremely high-profit odds. EURJPY 6m realized volatility has spent 78% and 89% of the time below the current variance swap bid level since 2007 and 2011 respectively.

We keep our EURJPY bullish bias as a directional reflation trade, which can be advantageously expressed via a zero-cost 3m topside seagull strikes 123.1715/121.1217/125.

Volatility trade: go short EURJPY 6m variance swap @14.3 (EUR indicative bid).

Trade risks: 6m realized volatility below 14.3 in 6m. Investors receive or pay the squared difference between the 14.3 strike and the terminal realized volatility and face unlimited losses if realized volatility is beyond this strike level.

Directional trades: Buy EURJPY 3m topside seagull strikes 123.1715/121.1217/125 Zero cost (indicative offer, spot ref: 120.9220).

Trade risks: unlimited below 123.1715. The structure is buying a standard call spread strikes 121.1217/125 fully financed by selling a put strike 123.1715. As such, investors face unlimited downside risk at the expiry if EURJPY trades below 123.1715.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close