The sentiment towards EM currencies remains quite positive. Even the long-suffering Mexican peso is able to benefit from this development. Some commentators have already declared that the peso has seen the worst. Ofcourse, the fact that the Mexican central bank hiked its key rate by a further 50bps makes the peso increasingly attractive with a key rate of 6.25%. Presumably, further rate hikes are yet to come – despite the fact that the economy is facing tough headwinds.

However, the weak peso as well as the government’s energy reform that led to a notable rise in gasoline prices at the start of the year entails risks for inflation. In January the latter rose from 3.4% to 4.7%. Even if the rise is likely to be temporary - so as to avoid possible second round effects the central bank is implementing an active monetary policy.

Seen in isolation this is good news for the peso. It is nonetheless unlikely to prevent the peso from suffering as a result of the US central bank’s monetary policy – as was the case last year.

Another obstacle is the unpredictability of Trump’s politics. The resulting uncertainty for the Mexican economy does not exactly encourage investments into MXN at present in, our view. We, therefore, struggle to believe in a continued peso rally.

OTC updates and hedging outlook:

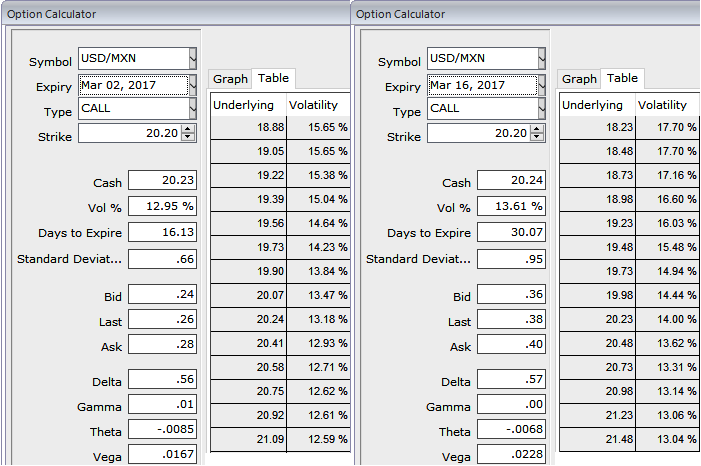

While ATM IVs of this pair is substantially spiking higher above 12.95% and 13.61% for 2w and 1m tenors which is conducive for the holders of the call options, but using the minor dips in this underlying pair writing narrowed tenor OTM calls would reduce the cost of hedging.

Thus, using any abrupt dips, initiate a diagonal debit/bull call spread (DDCS) at net debit.

The execution: Initiate shorts in 1W (1%) out the money calls with positive theta, simultaneously, buy 1M (1%) in the money 0.51 delta call option. Establish this option strategy if USDMXN spot FX is either foreseen to be in sideways or spike up considerably over the next month but certainly not beyond your upper strikes in short run.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data