Stronger than expected data out of the U.S. supported this week's risk-on bias in global financial markets. Nonfarm payrolls took centre stage at the end of the week adding 242k jobs in February.

Though we are of the view that the Fed will remain on the sidelines on March 16th, the improving domestic backdrop supports our view that the Fed will continue on with its gradual tightening cycle in June.

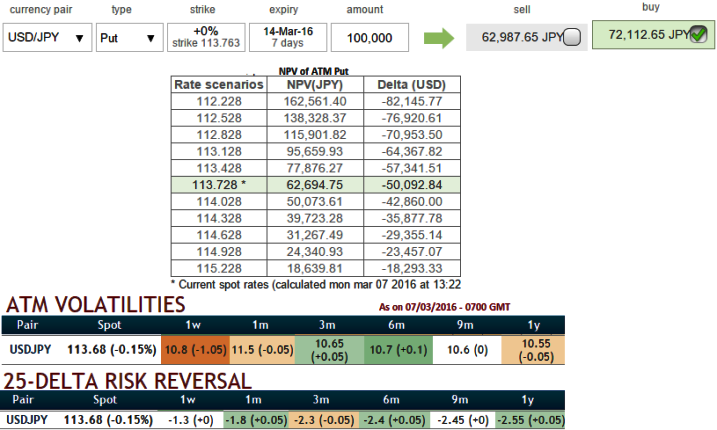

The implied volatility of ATM contracts for near month expiries of this the pair is at around 11.5% and for 1w expiry at 10.8%. , delta risk reversal for the pair is still the highest negative values among entire G10 currency space for all expiries, so we believe any abrupt short term upswings are the best advantage for bears and may be utilized for shorts in hedging strategies so as to reduce the hedging costs. (Compare delta risk reversal with last week).

NPV of 1w ATM put of USDJPY is JPY 62,694.74 while premiums trading above 15.02% at JPY for lot size 100,000 units. Thereby, disparity between IVs and option pricing exists.

Hence, those who compare this difference in options premium with implied volatility, and think the hedging cost for downside risks would not be economical as result of deploying ATM instruments.

Contemplating that factor we cannot afford to remain stuck in this riddle without hedging, so what could be the alternative, in forwards markets at least..?

Subsequently, here comes the "arbitrage strategy" in which options trading that can be performed for a riskless profit as USDJPY ATM put options are overpriced relative to the underlying exchange rate of USDJPY.

To perform this conversion, at USDJPY spot ref 113.684,

the hedger shorts the underlying spot FX and offset it with an equivalent synthetic short put (i.e. short spot FX + long ATM call) position.

Profit is locked in immediately when the conversion is done, the profit would be the difference between the short price of spot FX and price of forward price and premium paid.

FxWirePro: Does USD/JPY overpriced put make you scapegoat? – arbitrage via synthetic put serves alternative way to hedge

Monday, March 7, 2016 8:12 AM UTC

Editor's Picks

- Market Data

Most Popular