The US dollar outperformed the other G10 currencies this week except for the Norwegian krone. The move higher in US yields as the market priced in a June Fed hike boosted USD, while higher oil prices helped NOK keep ahead slightly.

The euro was struck by profit taking as it gave back some of the gains it accrued ahead of the French runoff vote this past weekend as the market priced-in a Macron victory.

The Swiss franc lost further ground as EUR/CHF continued its climb with receding European political risk.

CHF was the worst performer in our sample. The NZ dollar meanwhile was hit by a firmly neutral RBNZ policy statement, confounding speculation about a shift to a slightly more hawkish message.

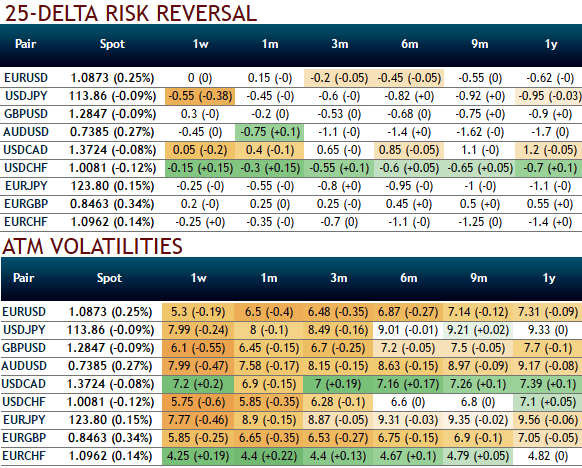

The nutshell above evidencing delta risk reversals and IVs indicates the hedging sentiments for dollar’s robustness and bullish risks (except USDJPY and USDCHF). While IVs have been tepid to signify option writers’ advantage in spreads like structures.

While the 1st chart explains the difference between net spec positions in the recent times on risky & safe currencies Net spec position is calculated in USD across 5 "risky" and 3 "safe" currencies (safe currencies also include Gold).

These positions are then scaled by open interest and we take an average of "risky" and "safe" assets to create two series. The chart is then simply the difference between the "risky" and "safe" series.

The second chart shows that the rolling 21-day beta of the Barclay Hedge FX index with the JPM USD tradable index vs. the net spec position in the USD as reported by the CFTC. Spec is the non-commercial category from the CFTC. Net spec position below is with one week’s lag.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields