Last week, bullish engulfing candle pattern occurred at 121.0420 levels, where we see the current prices struggling to break stiff resistance at 121.0887 levels.

As the current prices slid below 7WMA and 21WMA is on the verge of crossing over 7WMA which would be the bearish crossover.

Consequently, the recent upswings are absolutely exhausted after whipsaws from 8-weeks, for now, shooting stars are now dragging price declines to 3-months lows (refer weekly charts).

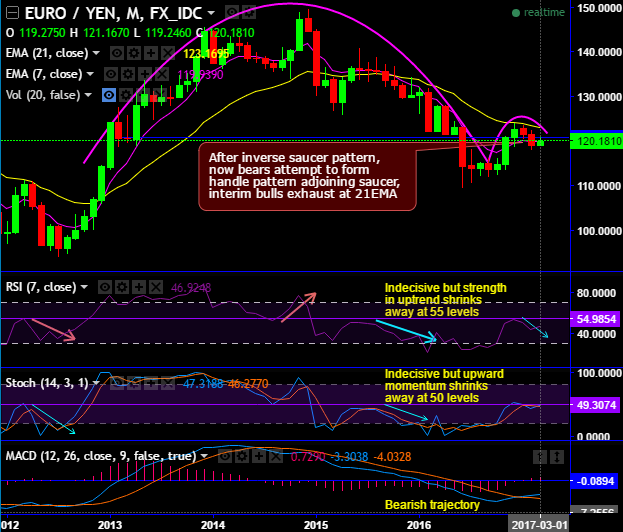

After inverse saucer on EURJPY, adjoining handle pattern is now on cards as interim bulls seem to be absolutely exhausted below 21EMAs (refer monthly charts).

As stated in our recent technical write up on this pair, rallies have extended upto 120.8326 levels or 21-EMA on monthly plotting. As a result, the bear swings seem to be gaining selling interest at this juncture, that is where attempts of price drops considerable.

Subsequently, both on weekly and monthly plotting, RSI (14) has been converging below 55 levels (while articulating) to the declines that signal the strength in downtrend, while stochastic curves are also (at 50 levels)evidencing %D crossover that signal strong selling momentum but this has been little indecisive on monthly terms although bearish biasedness is seen.

Both leading indicators on weekly terms signal intensified selling momentum, while MACD with bearish crossover indicates the extension of price declines.

Thereby, the 6 months of consolidation phase now seems to be deceptive and extension of dips seems most likely as lagging oscillators have been indecisive but slightly in bears favor.

Trading tips:

Contemplating above technical reasoning, on hedging grounds we advocate shorting futures contract of mid-month or near month expiries to arrest potential slumps up to 118.0703, 113.6590 and 112.5064 levels also cannot be ruled out upon breach of 1st two targets.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.