We know that bullish trend has again resumed and it likely to drag further to higher levels up to 1.0705 levels. Uptrend seems to be intensified especially after RBNZ stood pat in its yesterday’s monetary policy, leaving the OCR unchanged at 2.00%, which is in-line with the market expectations.

The MPS (monetary policy statement) acknowledged the economic developments since August and the NZ dollar has risen more than expected. After the central bank’s MPS, the market pricing for a November OCR cut has risen to around a 70% chance.

Technically, the flurry of bull streaks has been observed for this pair from last 6-7 consecutive days clearing major support levels in between this bullish rout. Current prices have spiked above DMAs to trade above 1.05 marks. So, any abrupt dips should be effectively utilized to build the ideal hedging strategy for the further upside risks.

1w ATM AUDNZD IVs are trading at 6.23% which is on a very lower side, while probabilistic numbers of put options signify the OTM strikes.

We know the rule that during higher IV circumstances, the market thinks the price has the potential for larger movement in either direction and lower IV implies that the OTC market anticipates the underlying spot price would not move much and so that it is beneficial for option writers.

As a result, one can think of reducing the hedging cost by deploying ITM shorts in call back spreads.

Hence, we recommend initiating more long call positions so as to hedge upside risks in this pair, call ratio back spread may probably attain the ideal hedging objective by reducing the hedging cost as well.

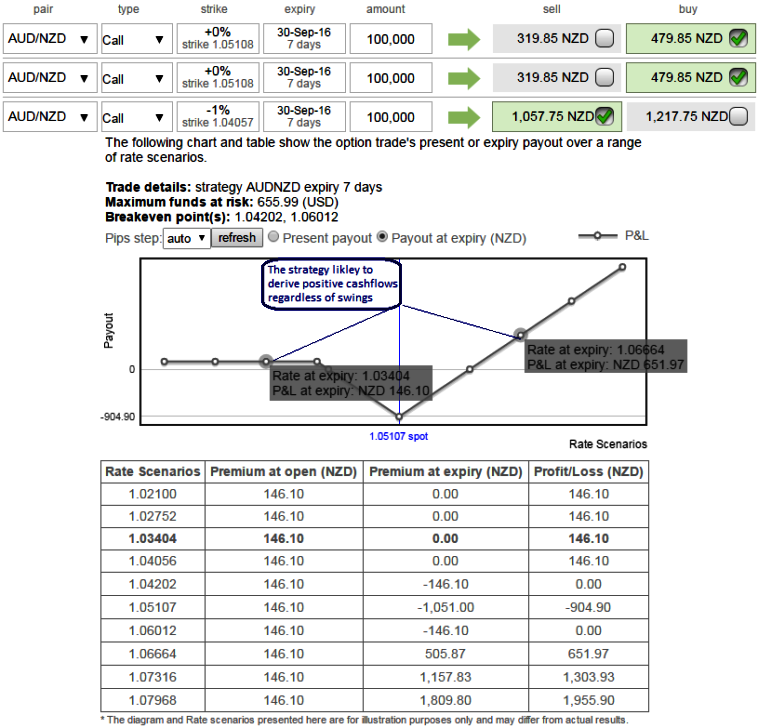

Hence, the strategy goes this way,

Long leg: 1M ATM +0.51 delta call, 1 lot of (1%) OTM +0.37 delta call and

Short leg: Simultaneously short 1 lot of deep OTM call (1%) of 2w expiry or with a comparatively shorter expiry in the ratio of 2:1.

The lower strike short calls seems little risky but because IV is reducing, the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1% OTM calls as well) and the position is entered for reduced cost.

As you can clearly observe that the irrespective of underlying spot rates, the above positions likely to derive positive cashflows.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data