This write up is articulated with a view to intend to prefer volatility spread due to the divergence offered by two G10 currency pairs (i.e. EURUSD & USDCHF) post-Brexit referendum.

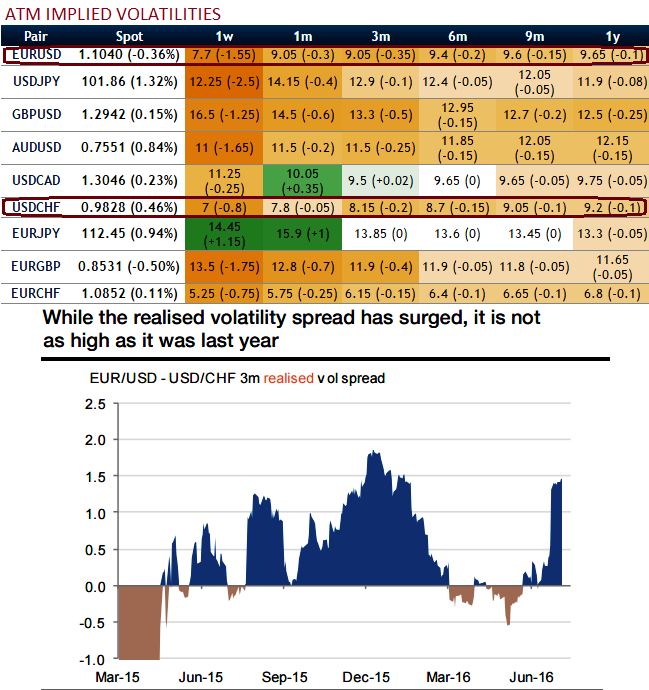

An expensive and asymmetric spread EUR/USD 3m vol is trading about one volatility point above USD/CHF 3m vol (see above diagram), the widest spread since 2011. This expensive market pricing is not sustainable.

The spread widened post the UK vote, as EUR/USD moved more than USD/CHF. Both vols subsequently fell, but the spread is still elevated, which seems an inconsistency.

The implied vol spread surged in following the spike in the realised volatility spread (see above diagram).

While the 3m realised vol spread is elevated, it is not as high as it was last year when it spent some time above 1 vol, while the implied spread remained capped below 0.5 vols.

USD/CHF volatility can be seen as EUR/USD volatility with a tilt of CHF risk. Unlike the other two, EUR/CHF volatility usually trades at a large premium above its realised volatility, but this premium recently contracted, suggesting that CHF risk has become surprisingly cheaper.

The adjustment would lift USD/CHF volatility higher. With its relative value profile, the EUR/USD vs USD/CHF vol spread is asymmetric and is likely to perform in various market scenarios.

In more risk aversion scenario: It should support both vols, but the spread is already extreme and the CHF should outperform as a safe-haven currency.

During less risk aversion scenario: It should continue to pressure both vols, with EUR/USD catching up with the already-lower USD/CHF volatility, as CHF risk would stay contained.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts