The genuine reason is that we have maintained a bearish view on EM FX basket and geared our portfolio construction to long dollar positions and relative value opportunities that should perform well in a rising USD-EM environment, is that macro risks (Fed, China growth, RMB depreciation) were underpriced so far this year.

In 2015, these three factors were responsible for the poor performance of EM currencies and arguably heading into early January they were significantly over-priced.

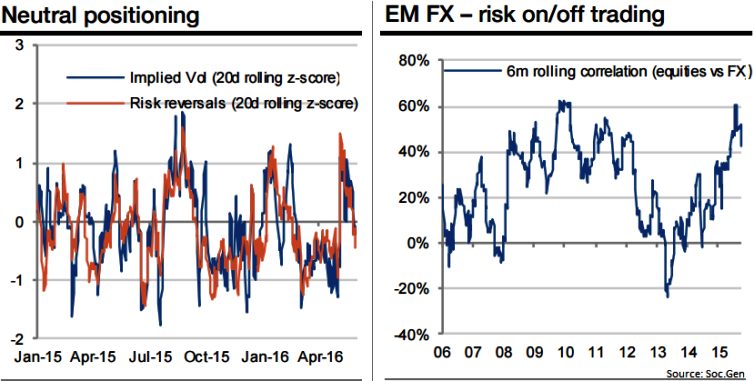

This is not good news for emerging market currencies, which have been decidedly trading in a risk on-off manner over the past couple of years.

The 6m rolling correlation between EM FX and equities is off the peak, but still elevated in a historical context.

Similarly, the correlation between oil and FX has been very high, but the resilience of commodity prices in the past 6 weeks during the USD-EM upturn possibly indicates that they become less important for determining the evolution of EM currencies.

We expect further losses in EM FX in the coming months and our portfolio is positioned accordingly.

We are long USDPHP and long USDZAR and are happy holding these or initiating new exposure at current levels.

We kept urging for long USDKRW via call spreads and they have done well so far, though chasing spot at current levels is risky given the KRW underperformance.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed