Among EMFX we stay MW TRY in the GBI-EM Model Portfolio, the resolution of uncertainty after last week's referendum opens the door for a relief rally in the short-term, but medium term concerns remain; stay MW TRY in the GBI-EM Model Portfolio. The Turkish referendum last weekend was in line with our expectations.

The package of constitutional amendments was approved by a weak “yes” (51.4% approval vs 48.6% reject, according to the latest available data from unofficial results). The opposition party CHP’s appeal on the referendum result has also been rejected by the Turkey election board. This result is the most market-friendly outcome by tapering the political noise for the time being.

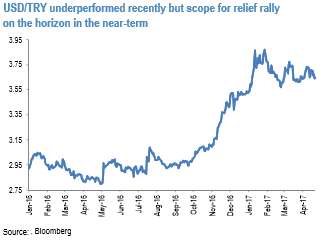

Judging from recent comments by the Turkish officials, early elections this year are very unlikely and therefore the political risk calendar for the remainder of the year is light. With the weight of political uncertainty no longer bearing down on Turkish lira assets, we think there is scope for a relief rally in the currency over the short run given its significant underperformance in recent months (refer above figure).

Medium term, however, we remain MW TRY in the GBI-EM Model Portfolio as the lira is likely to resume a depreciation trend later in the year when the central bank unwinds its tight liquidity policy.

Outright trades:

On hedging grounds we advocate following FX derivatives trades:

Short EURILS via mid-month forwards.

Long 26-Apr-17 EURPLN call (4.25), spot ref: 4.200.

Short 27-Nov-17 EURCZK forward.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays