- ETH/EUR is extending downside from 1150 levels, currently hovers around 1000 mark after hitting session lows at 961.

- The pair spiked past 1000 barrier to hit fresh all-time highs at 1150 levels.

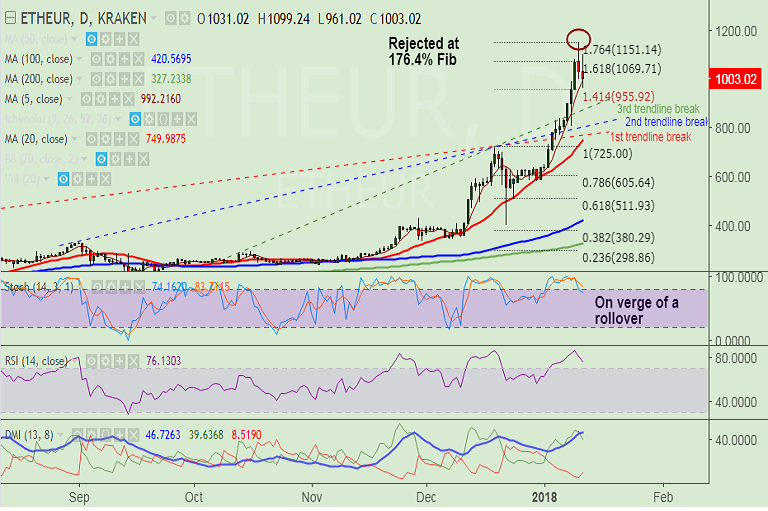

- But, price was rejected at 176.4% Fib at 1151, break above needed for further upside.

- Technical bias still bullish on the daily charts, but we see some weakness on the hourlies.

- 1H 100-SMA at 981 is immediate support, decisive break below could see drag lower.

- Close below 5-DMA at 992 on daily charts could see retrace upto 885 levels.

- Breakout at 1151 finds next bull target at 1219 (188.6% Fib) ahead of 1282 (200% Fib)

Support levels - 1000, 992 (5-DMA), 981 (1H 100-SMA)

Resistance levels - 1069 (161.8% Fib extension of 167.22 to 725 rally), 1151 (176.4% Fib), 1219 (188.6% Fib), 1282 (200% Fib)

Recommendation: Watch for decisive break below 1H 100-SMA for further weakness.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest