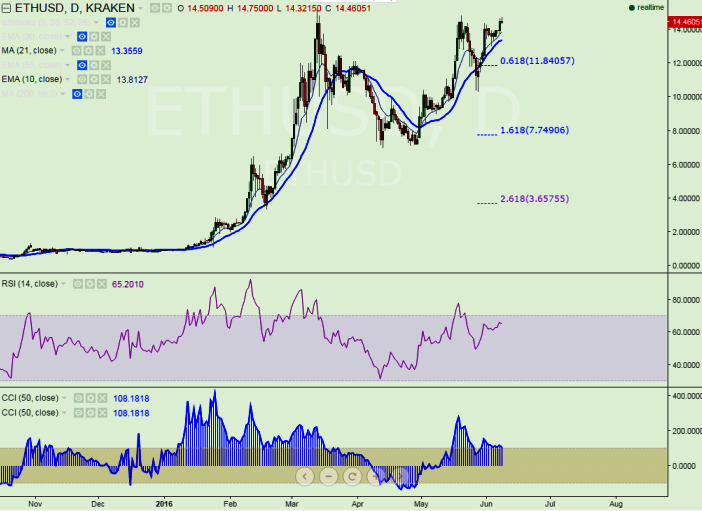

- Major intraday support - $13.20 (21 day MA)

- Major resistance- $14.40

- The pair has broken major resistance $14.40 (May 31st high) and jumped till $14.75 at the time of writing .Ethereum short term resistance is around $14.85 and any violation above will take the till $15.20/$15.75 in the short term.

- On the downside minor support is around $13.60 and any break below $13.60 will take the pair down till $13.40/$13.20/$13

- The pair should close below $13.20 for minor weakness till $12.55/$11.85/$11.20 level. Short term weakness only below $10.

It is good to buy at dips around $14 with SL around $13.55 for the TP of $14.85/$15.20