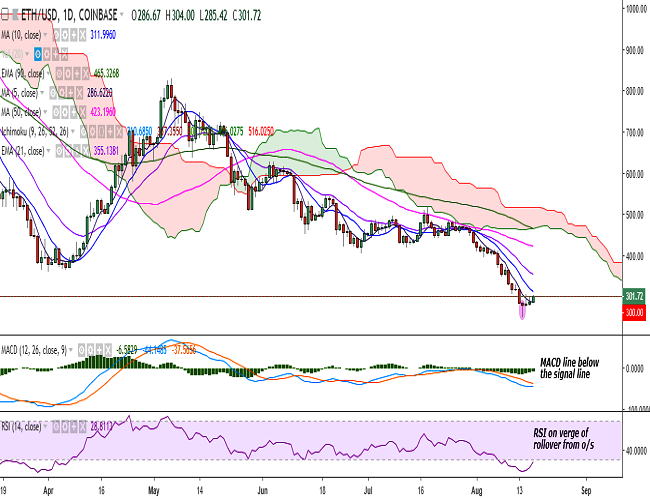

(Refer ETH/USD chart on Trading View)

ETH/USD is trading in the green on Friday just shy of 10-DMA resistance.

It is currently trading at 301 levels at the time of writing (Coinbase).

On the upside, a decisive break above 311 (10-DMA) would see the pair testing 355 (21-EMA)/366 (20-DMA)/386 (23.6% retracement of 828.97 and 250.28)/400.

On the flipside, support is likely to be found at 290 (1h 50-SMA) and a break below would drag it to 250 (August 14 low)/ 237 (113% extension of 828.97 and 305.14)/200.

On the daily chart, RSI and stochs are on the verge of a rollover from oversold levels. The hammer pattern suggests scope for further upside.

A close above 10-DMA would see minor bullishness in the pair.

FxWirePro: ETH/USD tests key resistance at 300, close above 10-DMA to see further bullishness

Friday, August 17, 2018 10:17 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary