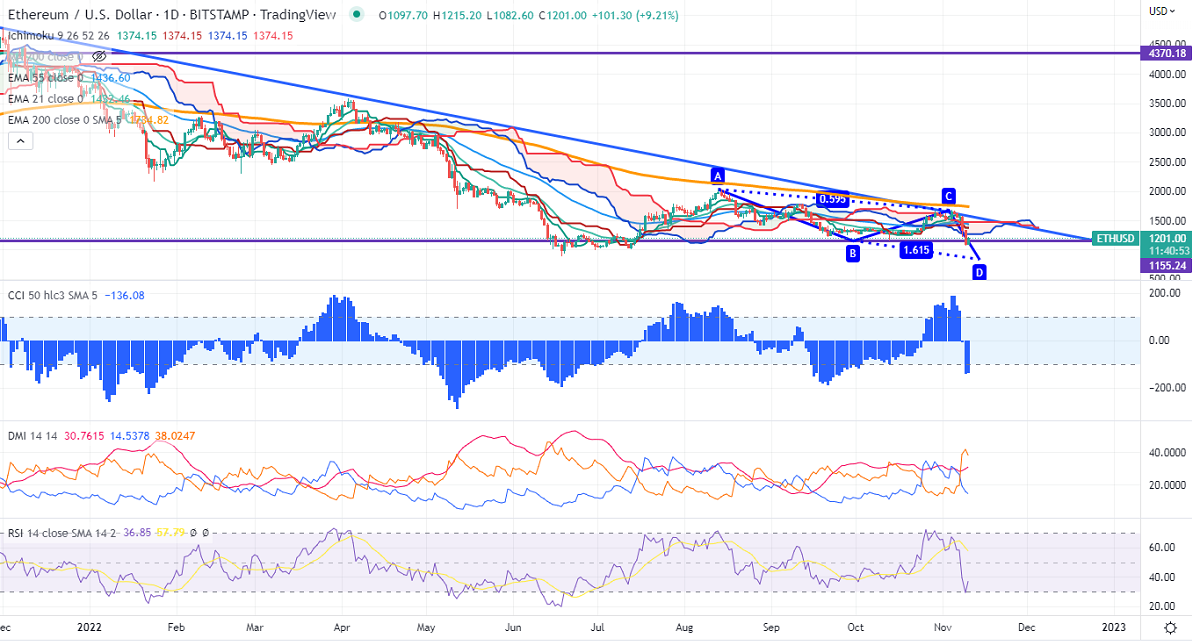

Harmonic pattern- Bullish AB=CD pattern

Potential Reversal Zone- $832

Key Highlights

ETHUSD declined drastically by more than $500 in the past two days as FTX expected to file bankruptcy, the third world's largest digital exchange. It hits a low of $1071.50 and I currently trading around $1184.90.

It is trading well below the daily Ichimoku Kumo cloud which confirms the minor weak trend.

Major support - $1070. Any violation below this level confirms bearish continuation. A dip till $1000/$880/$830.

The pair holds below Tenken-Sen ($1374.15) and Kijun-Sen ($1374.15). Tenken-Sen crosses below Kijun-Sen in the daily chart show bears are in control and better to avoid fresh longs.

A short-term trend reversal may happen if Ethereum closes above $1375. A jump to $1450/$1676 is possible.

Indicators (Daily chart)

RSI- uptrend (above 35)

Resistance

R1- $1375

R2- $1450

R3- $1700

Support

S1- $1070

S2- $1000

S3- $830