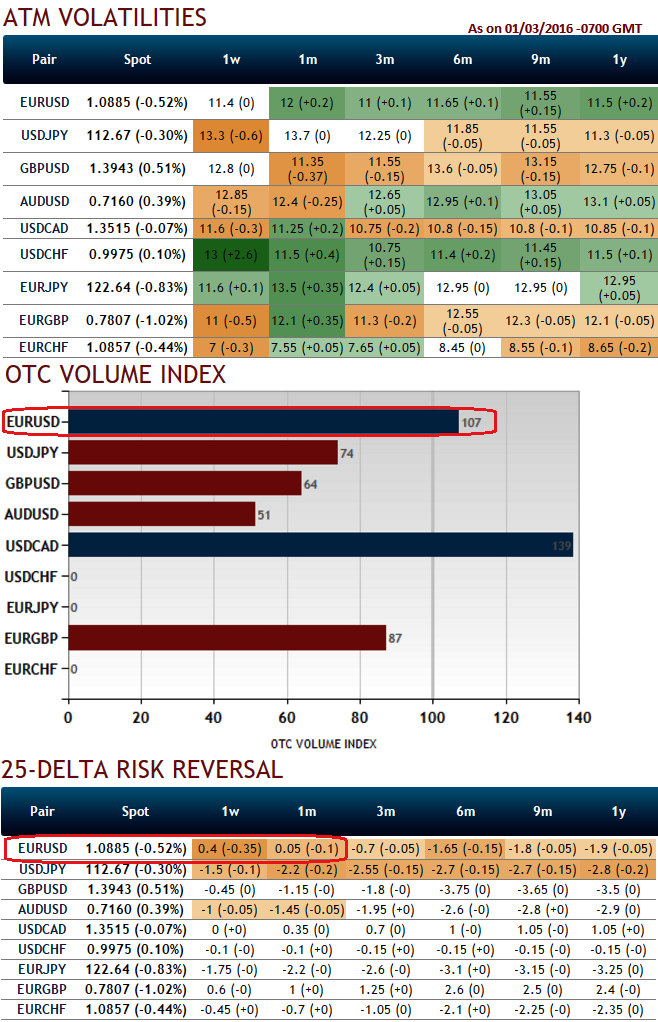

The recent market focus on the EU referendum has meant that GBP downside options have become very expensive. Yet despite the recent move lower, vol-adjusted EURUSD skew remains relatively elevated, in our view (see ATM vols and OTC VIX for the pair).

As the euro zone economy continues to stagnate, the proportion of British trade accounted for by the rest of the EU is falling, and non-European markets are becoming more important for British exporters. However, this is not a concrete reason for the UK to leave the EU.

If GBP keeps tumbling, it drags euro too to the deep tunnel, the spillover effects on euro because, there would be uncertainty about the future of trade between euro bloc and the U.K., which is the EU's second-largest economy after Germany. The departure of the U.K. could also buoy up populist parties in the rest of Europe to seek a better deal from the EU, or the trade terms may even shrink away.

We think that the referendum is at least as big a risk to EU and EMU stability as it is to the UK economy and, as a result, recommend owning EURUSD downside as a cheaper proxy to hedge the EU referendum risk. With GBP option prices already heavily skewed to the downside, EURUSD is a cheaper alternative.

Moreover, if you glance over the risk reversal nutshell, perhaps OTC market arrangements may baffle sentiments of the spot FX trend directions. For contracts expiring in 1W-1M are displaying little upticks, however, losing momentum drags back the bearish sentiments in long run. As a result OTM puts of 6M-1Y year expiries are trading relatively expensive.

An indicative trade would be selling a 1m 1.06 EURUSD put to finance the purchase of a 4m 1.06 EURUSD put for a 1% premium. Given our Q2 2016 forecast of 1.03, the payoff of this trade, net the upfront cost, would be close to two-to-one, with breakeven level of approximately 1.05.

FxWirePro: EU referendum risks EURO as much as sterling- stay hedged in EUR/USD via diagonal spread with reduced cost

Tuesday, March 1, 2016 11:48 AM UTC

Editor's Picks

- Market Data

Most Popular