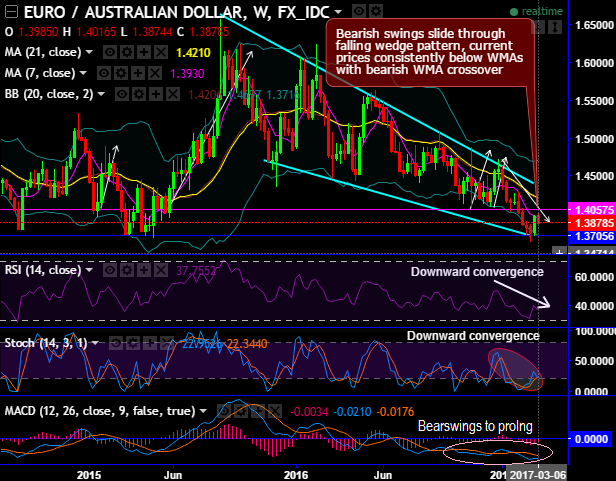

Ever since the pair tumbled from the 2015 peaks of 1.6585 to the current 1.3890 levels, you could very well observe that the price behavior has been in the form of falling wedge pattern.

As the bearish swings slide through falling wedge pattern, the current prices consistently below WMAs.

Major downtrend slide in falling wedge, the current prices below EMAs again, Can bears manage to break below strong support @ 1.3812 upon bearish EMA crossover?

While both leading and lagging oscillators on monthly charts indicates bearish momentum by converging downwards to these price dips.

RSI: Currently, RSI (14) on weekly has been little indecisive but clearly converging downwards to the prevailing price dips that signal the strength in selling pressures on monthly terms.

Stochastic: This leading oscillator has approached oversold territory but still evidences %k crossover to signals continued selling momentum on both timeframes.

On a broader perspective, MACD evidences bearish crossover below zero levels on weekly plotting and at zero levels on monthly terms that signal the bearish trend to prolong further.

Having said that, overall the major downtrend of this pair remains intact, and it is likely to extend further.

FxWirePro currency strength index that measures the price performance of the basket of currencies on hourly basis indicates the robustness of Aussie dollar, while euro is trading in a neutral mood after RBA maintained status quo in their monetary policy meeting by keeping cash rates at 1.5%.

For more details on our index please visit below web link:

http://www.fxwirepro.com/fxwire/currencyindex

Trading tips:

On speculative grounds, as a result of above technical reasoning, we advise tunnel spreads which are binary versions of the debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 1.3964 and lower strikes at 1.3775 levels.