- EUR/AUD extending downside for 2nd consecutive session, down 0.18% on the day.

- Aussie supported on upbeat Australia trade & housing data released earlier today.

- Australia's trade balance widened to AUD 1,745 million in September vs. AUD 1200 million expected. Exports rose 3% m/m, while imports growth stalled.

- Meanwhile, building approvals for September rose 1.5% m/m vs -1.0% expected and 0.4% last.

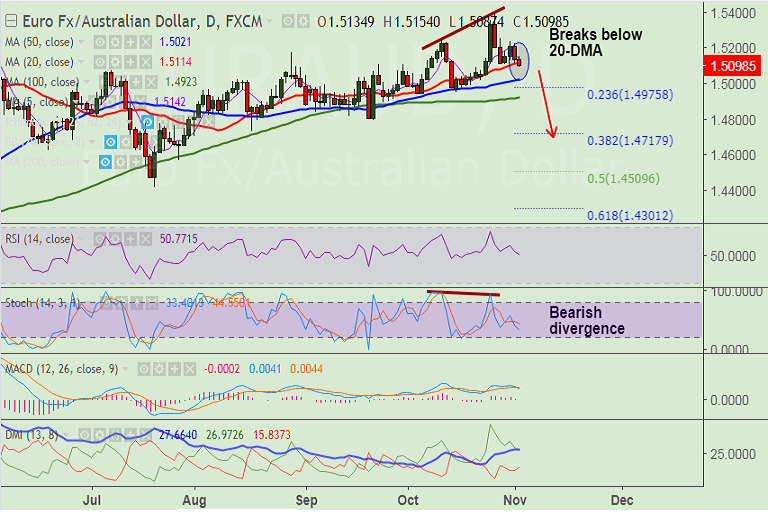

- EUR/AUD has slipped below 20-DMA at 1.5114, bias lower. We see scope for test of 50-DMA at 1.5021.

- Bearish Stochastics divergence adds scope to further downside. Violation at 50-DMA finds next support at 100-DMA at 1.4923.

Support levels - 1.5021 (50-DMA), 1.5015 (Oct 23 low), 1.4975 (23.6% Fib retrace of 1.3626 to 1.5392 rally), 1.4923 (100-DMA)

Resistance levels - 1.5114 (20-DMA), 1.5142 (5-DMA), 1.52

Recommendation: Good to go short on rallies around 1.5110, SL: 1.5150, TP: 1.5025/ 1.50/ 1.4975,

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 27.7496 (Neutral), while Hourly AUD Spot Index was at 139.509 (Bullish) at 0700 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest