EUR/AUD was up +25pts in Asia on AUD led weakness after Australia's trade deficit widened to A$3.3 billion, compared to forecasts of A$2.6 billion.

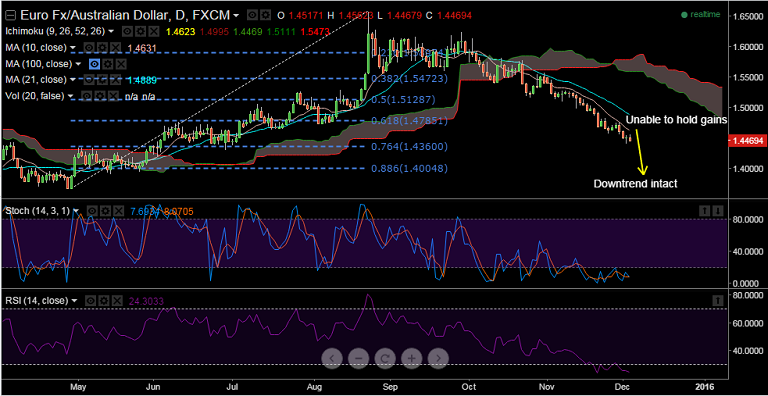

- The pair could not hold on to gains, has slipped lower and is currently trading at 1.4482 after hitting session highs at 1.4562

- The pair has retraced over 75 % Fibo of the 1.3677 to 1.6584 (Apr - Aug) rise, momentum studies, 5, 10 & 20 DMAs head lower - negative trending setup, close above 1.4632 (10 DMA) would suggest a period of consolidation

- Market focus on ECB today, uncertainty has surfaced on Draghi's ability to over deliver, should Draghi fail to do so EUR shorts likely to be squeezed

- Immediate resistance is seen at 1.4632 (10 DMA) ahead of 1.4785 (61.8 % Fibo of 1.3677 to 1.6584 (Apr - Aug) rise), while supports on the downside are seen at 1.4413 (Dec 2 low) and then 1.4360 (76.4 % Fibo of 1.3677 to 1.6584 rise)

FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds

NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds  FxWirePro: GBP/AUD key support held, downside risk remains

FxWirePro: GBP/AUD key support held, downside risk remains  AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip

AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip  FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  FxWirePro: EUR/NZD recovers slightly but bears are not done yet

FxWirePro: EUR/NZD recovers slightly but bears are not done yet  FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data

FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data  FxWirePro: GBP/USD slips ahead of Manchester local election

FxWirePro: GBP/USD slips ahead of Manchester local election  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish  FxWirePro: GBP/AUD extends drop, vulnerable to more downside

FxWirePro: GBP/AUD extends drop, vulnerable to more downside  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook