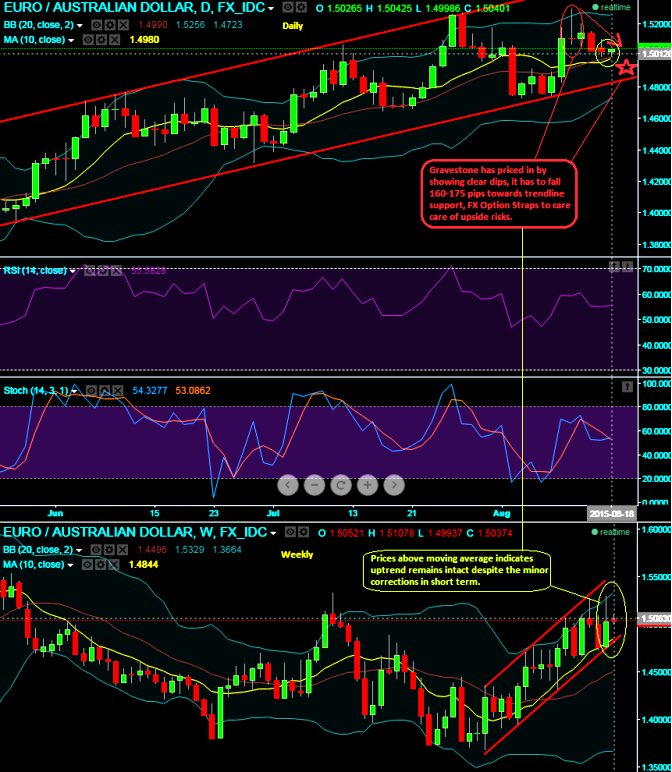

As we can make out from the daily chart a gravestone doji with long upper shadow has shown its impact in price drops. This doji at 1.5110 is still has downside potential for about another maximum up to 160-175 pips to test the trendline support which we reckon as a strong point where demand starts accumulating than supply but as of now it seems unlikely as bulls look desperate to capture this slumps with a better entry levels.

Although daily prices remained well above 10 day moving average, this has not been the case with intraday charts. As we know moving average is a lagging indicator, price sentiments for now is little bullish and average curve to follow this momentum later. So even if it falls further it should not exceed 160 -175 pips towards south.

Currency Option Strategy:

If any shorts or strips are open we advise those to be squared off, book the profits and for now convert the same into option straps on hedging grounds. Unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

So, Buy 15D At-The-Money -0.5 delta put option and simultaneously short 2 lots of 15D At-The-Money 0.5 delta call options. It involves buying a number of ATM puts and double the number of calls. The strap is more of customized version combination and more bullish version of the common straddle.

Hence, any hedger or trader who believes the underlying currency is more likely to surge upside can go for this strategy. Maximum returns can be achievable when the underlying exchange rate makes a strong move either upwards or downwards at expiration but with greater gains to be made with an upward move. Cost of hedging would be Net Premium Paid + brokerage/commission paid.

FxWirePro: EUR/AUD gravestone doji likely to drag maximum 160-175 pips - prefer straps for hedging

Tuesday, August 18, 2015 7:09 AM UTC

Editor's Picks

- Market Data

Most Popular