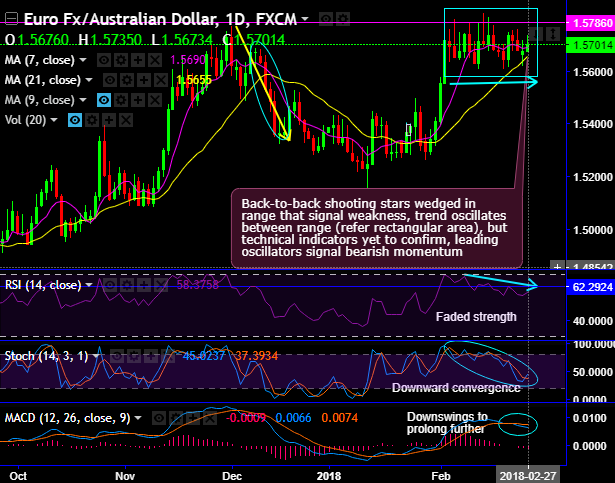

Chart and candlestick formed: EURAUD forms whipsaws pattern on both daily and 4th weekly and shooting stars, gravestone doji have occurred at 1.5676 and 1.5683 levels respectively on weekly chart to signal weakness.

Most importantly, the whipsaws pattern have occurred at stiff resistances of 1.5678 levels, historically the same pattern has evidenced considerable price slumps upto 1.5155 levels.

The similar chart pattern is now popping up with above stated bearish candlestick formations.

As a result, the current trend is most likely to slide below 7EMAs.

However, these bearish indications are mounting even though bearish momentum is intensified in minor trend, the trend should be backed by lagging indicators.

Well, on a broader perspective, in the recent history, the rejection at the stiff resistance of 1.5678 levels forms shooting star and hanging man pattern candles at 1.5622 and 1.5671 levels respectively. Ever since then, these bearish pattern candles have evidenced considerable slumps below 7EMAs to hamper the consolidation phase in the major trend (refer weekly plotting).

Historically, you could make out the prices have tumbled as it failed to sustain above this resistance level when leading oscillators confirmed bearish momentum and consequently, how the price has tumbled.

But here, in this case, the selling sentiments are yet to get the clarity from both momentum & trend indicators on the weekly timeframe.

Overall, the minor trend is all set to slide southwards to hamper the previous buying sentiments, whereas the major trend needs to get more clarity for now.

Nonetheless, as stated in our earlier write-up, we reiterate the extended upswings could only be expected upon a decisive break-out above stiff resistance of 1.5678 levels.

Having said that, we conclude by stating, overall, both major and minor trends seem to be edgy for now, while the aggressive bears may bet upon bearish streaks on intensified bearish momentum.

Trading tips:

Contemplating prevailing bearish sentiments, on trading grounds, it is advisable to snap deceptive rallies and deploy tunnel spreads with upper strikes at 1.5735 and lower strikes at 1.5610 with a view to participating in bearish rallies.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 62 (which is bullish), while hourly AUD spot index was at 84 (more bullish) while articulating (at 12:00 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: