• EUR/AUD strengthened on Tuesday as lower commodity prices and soured risk sentiment weighed on Australian dollar.

• Dalian iron ore fell over 2% and Lon copper eased 0.25% to weigh on Australian dollar.

• The pair is approaching 23.6%fib,a daily close below will accelerate towards 1.5500 in the short term.

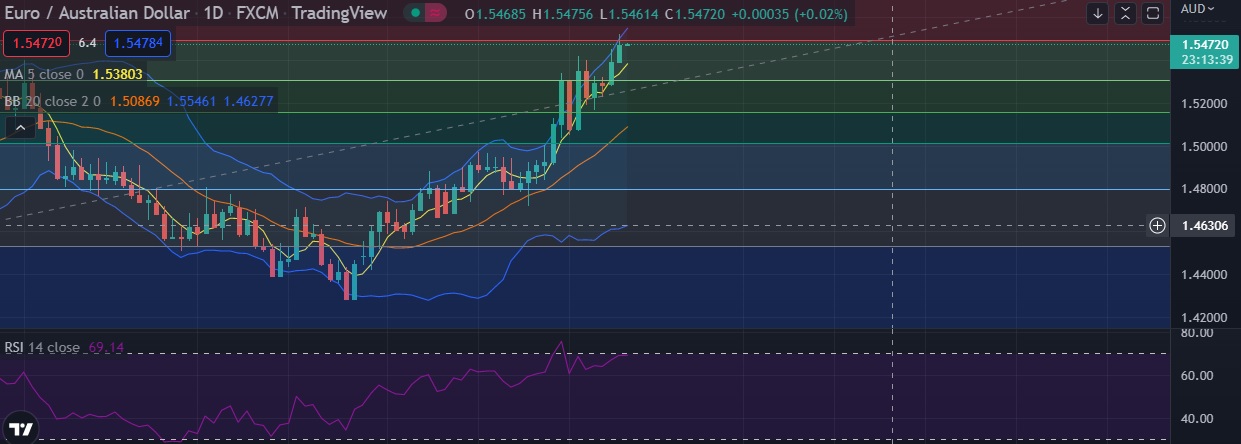

• From a technical viewpoint, RSI is strongly bullish at 69, daily momentum studies, 5, 10 and 11 daily MAs are pointing higher.

• Immediate resistance is located at 1.5496(23.6%fib), any close above will push the pair towards 1.5542(Higher BB).

• Immediate support is seen at 1.5383(5DMA) and break below could take the pair towards 1.5306(38.2%fib).

Recommendation: Good to buy on dips around 1.5460, with stop loss of 1.5380 and target price of 1.5500.