• EUR/AUD surged on Wednesday as the Australian dollar was weighed down by the dovish RBNZ and declining iron ore prices.

• The Reserve Bank of New Zealand concluded its latest policy meeting with a 25 basis point cut to the official cash rate, bringing it to 5.25%, marking the first easing since early 2020.

• Iron ore futures hit a year-long low on Wednesday, pressured by weak credit data from China, declining demand, and high supply.

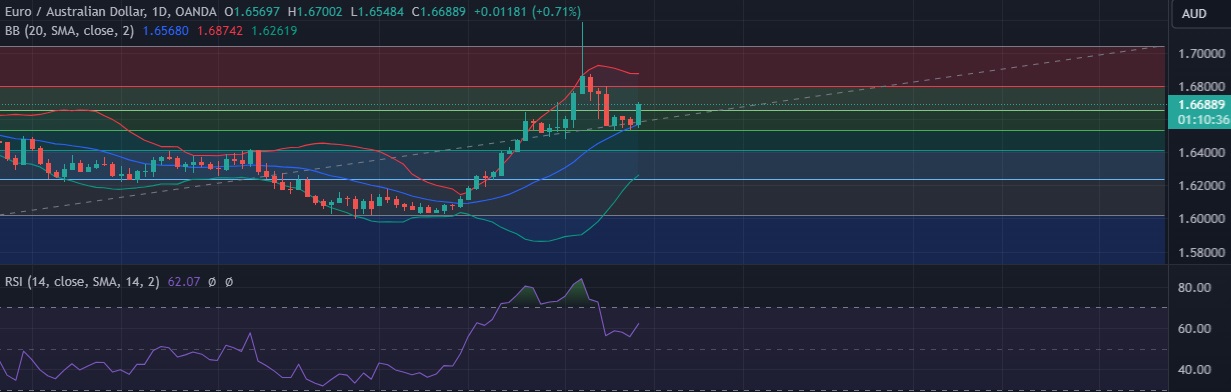

• Technicals highlight upside risks. The 10- and 21-day moving averages lend support, daily RSI is rising.

• Immediate resistance is located at 1.4880( 5DMA), any close above will push the pair towards 1.4936 (50% fib)

• Immediate support is seen at 1.6651 (38.2% fib) and break below could take the pair towards 1.6545 (50% fib).

Recommendation: Good to buy on around 1.6670, with stop loss of 1.6570 and target price of 1.6760